Making every basis point count

The Strategy is managed by the same highly experienced team behind the Pacific Coolabah Global Active Credit Strategy.

The investment team combines a proprietary quantitative asset-selection process with deep fundamental research to deliver returns in excess of SOFR (or equivalent risk-free cash rate) + 150 basis points net of fees each year. This long-only, absolute return global credit strategy focuses on mispricings in investment grade credit, targeting consistent alpha with an average portfolio rating of A to AA and near-zero interest rate duration.

The highly active “quantamental” approach integrates rigorous credit analysis of the strongest issuers worldwide with over 80 proprietary pricing models that identify opportunities for capital gains. Unlike traditional yield-driven strategies that depend on higher default risk, illiquidity, or derivative bets in efficient markets, we emphasise generating total returns from the most liquid, high-grade bond markets.

why the Pacific Coolabah credit alpha strategy?

CLIENT DRIVEN DEMAND

European and UK investors are driving demand for a highly liquid floating-rate global credit solution, building on Coolabah’s successful Pacific Coolabah Global Active Credit Strategy and its attractive risk-adjusted and absolute returns.

LEVERAGES COOLABAH’S UNIQUE AND SUSTAINABLE EDGE

A 53-strong highly quantitative global investment team, leveraging 80+ proprietary bond pricing models and systematic credit algorithms across USD, EUR, and AUD, has achieved a 92% win rate on ~US$38.3bn in IG primary market trades since 2021, delivering a 35.6% IRR with an average A credit rating.

DEMONSTRATABLE TRACK RECORD*

The strategy has delivered +5.5% p.a. net of fees with 3.6% volatility (Sharpe 1.1x), outperforming cash by +3.9% p.a. and the Global Aggregate Corporate Duration Hedged Index by +1.9% p.a., with similar volatility and lower credit risk.

*Strategy inception is 29 February 2012.

As at 30 September 2025

ABOUT COOLABAH CAPITAL INVESTMENTS (CCI)

DISTINCTIVE OFFERING

- USD 10.5 billion* AUM across a longstanding

diversified client base of institutional and retail investors - Active credit traders – executed ~USD60bn of global credit trades since 1 Jan 2021

HIGHLY EXPERIENCED TEAM

- Seasoned team with decades of experience in fixed-income management, trading, quantitative and credit research capabilities

- Focus on generating alpha in liquid, high-grade credit without taking interest rate risk

ESG INTEGRATED

- CCI is a signatory of the UN-supported Principles for Responsible Investment (“PRI”) and is accredited by the Responsible Investment Association of Australasia (“RIAA”).

- CCI runs several ESG-specific global long and long/short strategies.

*Source: Coolabah Capital Investments as at August 2025.

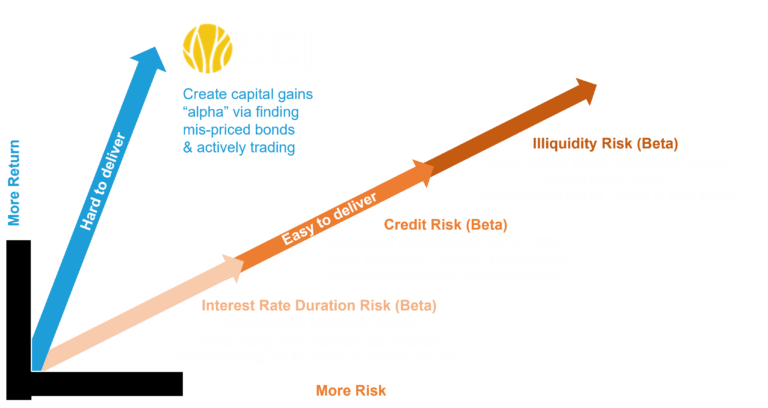

THE EXISTENTIAL CHOICE:

ADD-VALUE OR ADD RISK?

CCI focuses on trading high-quality bonds to reduce idiosyncratic risks

GLOBAL FIXED INCOME MARKET IS HIGHLY INEFFICIENT

Providing compelling active trading opportunities

Cash bonds are highly inefficient

Most investment-grade fixed income is traded OTC and by “voice”

- No transparent central exchange or mandated price disclosure

- Leads to highly opaque/inefficient asset pricing

Limited use of quantitative models for real asset valuation analysis

- Assets more commonly priced off crude appraisal/qualitative judgement

- Explains under investment in credit and quantitative research

Inefficiency compounded by proliferation of “passive” styles

Most “active” fixed income managers are very passive, “buy-and-hold” investors

- Function of predominance of passive fees for active styles

- Prevalence of closet indexers

Investors typically overdiversified

- Diversification can be a vehicle for taking much more credit risk or beta

Regulatory reform since the 2008 crisis has changed credit markets

Regulation such as the Dodd-Frank Act. / Volcker Rule has forced banks to withdraw from proprietary trading

Regulation such as Basel III has reduced the ability of banks and market-makers to hold inventory on their own balance sheets

- Bank warehouses have virtually disappeared

Market-makers also constrained from holding certain types of debt securities

All these factors contribute to market inefficiencies that Coolabah Capital Investments look to exploit

find out more:

Pacific North

of South EM All Cap Equity

Contact us

Speak to a member of the client team to find out more:

Contact us

Speak to a member of the client team to find out more:

Mary Murphy

Head of Distribution

(Single Manager Strategies)