Single Manager Solutions:

North American Opportunities

Thinking differently in North America

The Pacific North American Opportunities fund offers a distinctive investment opportunity defined by its unwavering emphasis on bottom-up analysis and stock-picking, de-emphasising macro-economic factors. The Portfolio Manager takes an all-cap, benchmark agnostic, concentrated approach, within a capacity constrained fund.

Specialists in North American Equities

The investment team for the North American Opportunities Fund is led by Chris Fidyk, a highly-experienced professional who has over 15 years of investment experience in North American Equity markets and a proven track record of generating returns in various market environments.

The manager combines consistent generation of eclectic investment ideas and in-depth bottom-up analysis within a framework that maximises the potential for outperformance.

A SIMPLE RECIPE TO TARGET OUTPERFORMANCE

1

Team

CURATED

to identify

ALPHA

The team, led by Christopher Fidyk and supported by research analysts Imogen Tyer and Sam Lewis search all areas of the US market, the team aim to know more about the companies than any other outsider. The team also draw on PAM’s wider institutional experience, expertise and infrastructure.

2

process designed

to capture

ALPHA

US market to identify companies where future outcomes can be understood with precision.

3

Fund structured

to maximise

ALPHA

The concentrated, capacity constrained .

Diversification and Flexibility

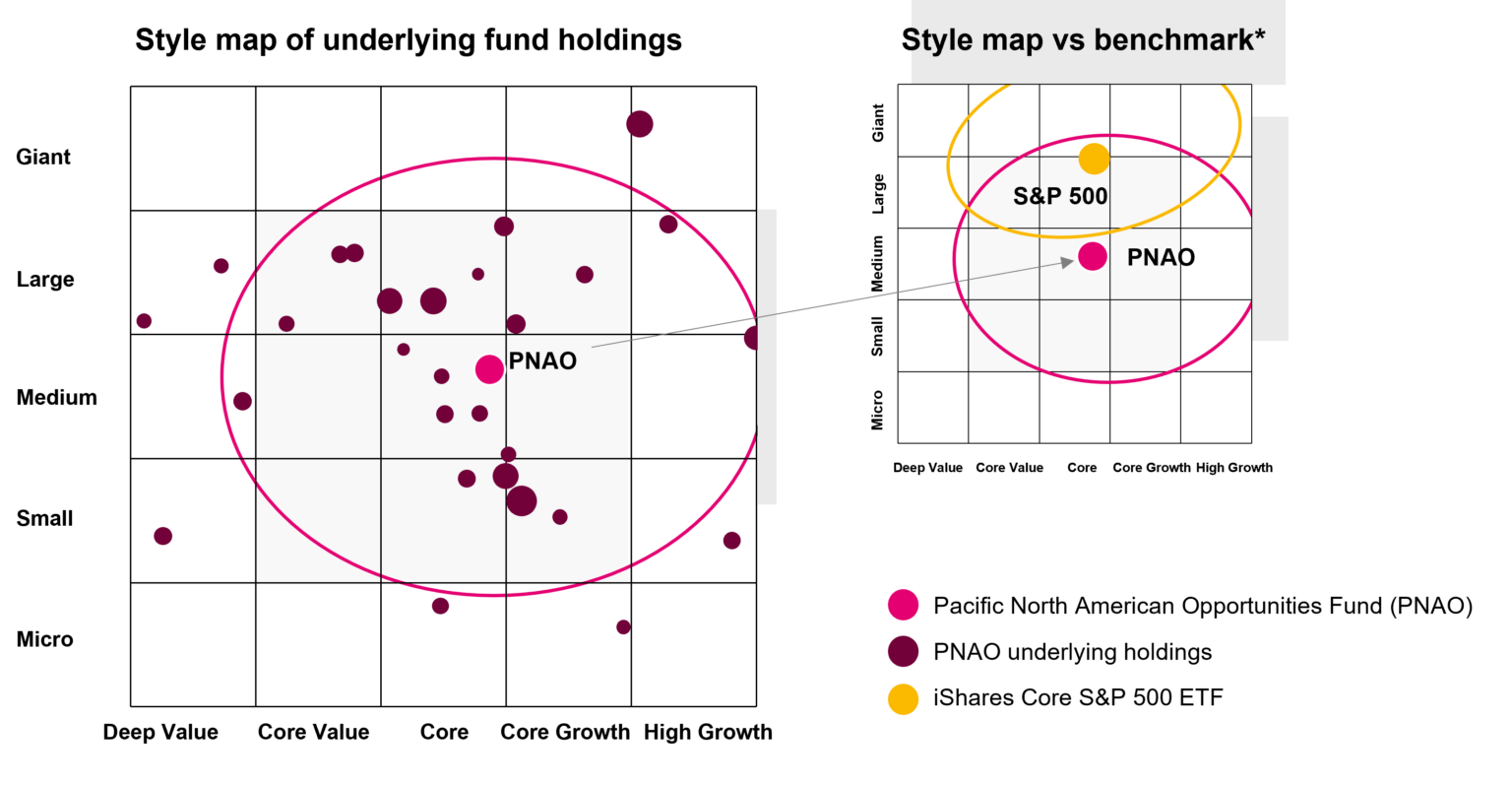

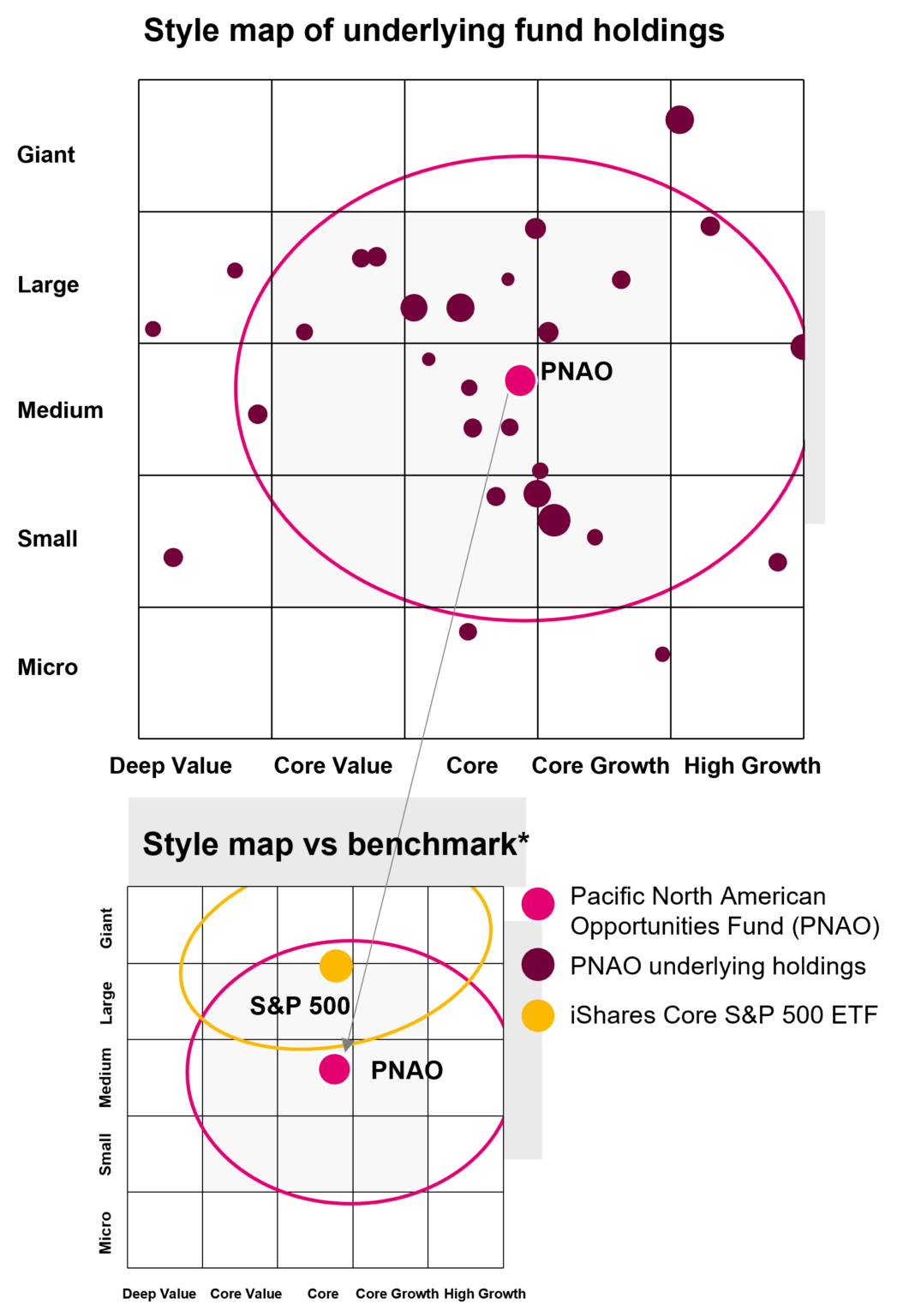

The portfolio, though concentrated, showcases diversification across different investment styles and market capitalisation ranges, presenting a varied collection of ideas as illustrated in the chart below. The S&P oval shape indicates a preference for larger stocks, while maintaining minimal exposure to mid-cap stocks, and virtually no involvement in micro to mid-cap stocks. Furthermore, the fund benefits from flexibility, allowing the portfolio manager to pursue opportunities across styles and market cap as they arise.

For Illustration Purposes Only.

* Benchmark used for comparison = iShares Core S&P 500 ETF

Source: Pacific Asset Management and Morningstar.

Why Invest?

Highly experienced Portfolio Manager with a long track record of generating outstanding returns in North American equities

Fund structured to maximise alpha; concentrated, all cap, benchmark agnostic, and capacity constrained

Three guiding principles that form a foundation for a well defined investment process of the fund to identify stocks that can outperform

Highly active, stock-picking focus with in depth bottom-up analysis that is not distracted by macro

Portfolio constructed of eclectic ideas that looks very different from the S&P 500

The team search everywhere possible for investment ideas with the goal to identify companies where future outcomes are inevitable

Portfolio team

CHRIS FIDYK

Portfolio Manager

imogen tyer

Research Analyst

Sam lewis

Research Analyst

find out more:

Contact us

Speak to a member of the client team to find out more: