During August the strategy outperformed the MSCI Emerging Markets index by 1.7% in what was the eighth consecutive month of positive returns for the index this year.

Key contributions to the outperformance came from positions in Korea and Brazil, exposure to precious metals mining as well as the underweight position in India. This was somewhat offset by weaker returns from the UAE and Greece.

During the month we exited Poland given the strong performance despite increasing political uncertainty. We also continued taking profits in the UAE. The capital was redeployed to add in Malaysia as well as cautiously picking up exposure in India to reduce our significant underweight in the market.

The last time the index had a positive streak lasting over 8 months was 20 years ago, when it rose for 12 consecutive months. While valuations across the board have clearly increased as a result, the index P/E remains quite close to the average for the past ten years. This is partly because it started off inexpensive, partly because a majority of year-to-date returns have been driven by currency (US dollar weakness).

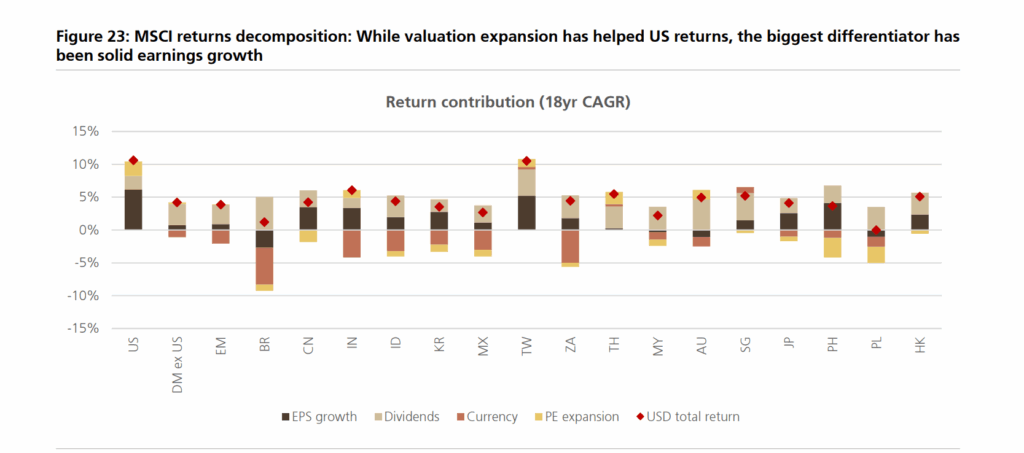

As an excellent chart from UBS strategists shows, this is unusual with almost all EM currencies having acted as a significant drag in past decades. A core part of our philosophy is that high relative domestic cost of capital in Emerging Markets is associated with a weakening currency over time – the exceptions that prove this rule are Taiwan and Thailand where rates have been consistently rock bottom. However, long-term US rates are now higher than almost all our markets – perhaps currency effects can indeed remain a tailwind.

We have written about the Taiwanese market and this is illustrated nicely in this chart. Returns in that market have been higher than in the US over this period, despite slightly lower EPS growth and lower multiple expansion. The key difference has been high Taiwanese dividend income – arguably a more stable driver of returns. We are also intrigued by markets that have seen a P/E derating, despite decent EPS growth and dividend contributions – the Philippines stands out in particular.

We do need to be forward looking – for example Korea should see dividend contributions significantly higher going forward thanks to value-up, but investors ignore market history at their peril. A chart says more than a thousand words!