Global markets were mixed in November, pausing after several months of strong gains. Volatility increased as concerns over stretched AI-related and technology stocks resurfaced, prompting a rotation towards defensive sectors such as healthcare and consumer staples, with the technology sector being challenged, and recording its biggest decline since March.

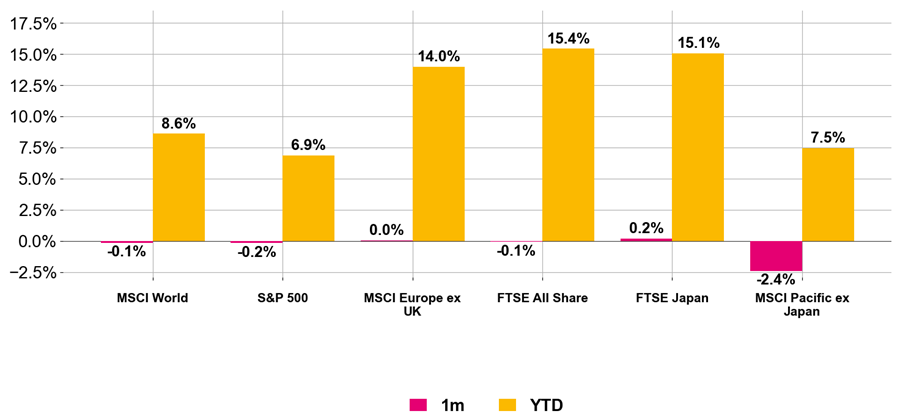

Figure 1. Regional equity returns (Source: Pacific Asset Management, November 2025).

US equities ended largely unchanged as investors looked past the positives of strong Q3 earnings and the end of the 43-day government shutdown – the longest in US history – and instead focused on uncertainty around interest rates and concerns around an AI-driven bubble and stretched technology valuations. Volatility was driven primarily by shifting expectations for Federal Reserve policy: the probability of a December rate cut swung sharply, falling from nearly 98% in late October to about 40% by mid-November, before rebounding above 80% by month-end. Market moves reflected not only the potential timing of rate cuts but also investor interpretations of the Fed’s economic outlook and the likelihood of a soft landing.

Across the Atlantic, Eurozone inflation in November ticked up to 2.2% from 2.1%, slightly above forecasts and suggesting that price pressures remain. Economic expansion was modest, with Q3 growth at 0.2% and unemployment steady at 6.4%. The ECB indicated a cautious stance, signalling that keeping interest rates unchanged remains the prudent course. European equities remained relatively flat as investors navigated these mixed economic indicators.

In Japan, headline inflation climbed to 3.0% in October – the highest since July – driven by energy costs, currency fluctuations, and ongoing supply chain strains. A softer yen provided support to export-focused equities but also contributed to higher inflation, while government bonds underperformed as yields rose amid doubts over the long-term sustainability of fiscal and monetary support.

The UK’s Autumn Budget 2025, long anticipated and partially pre-empted by the early OBR publication, had a relatively muted immediate impact on markets.

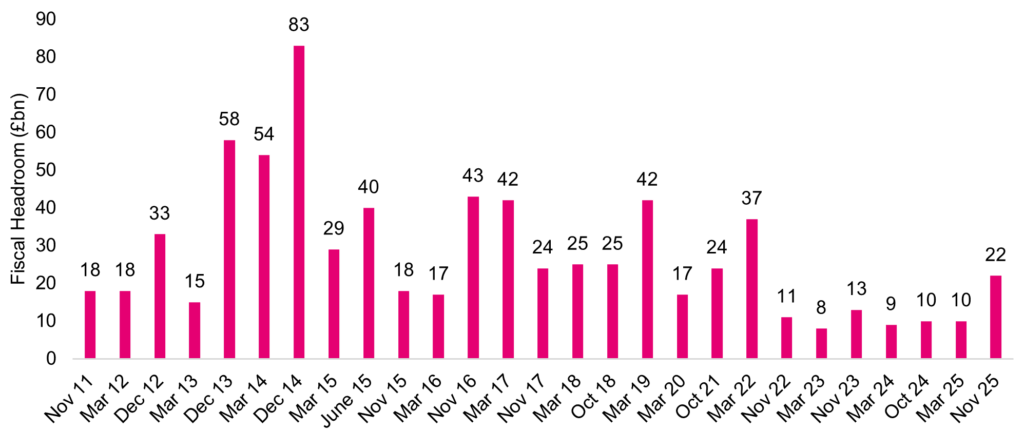

The Chancellor outlined £26 billion in tax measures; however, with many provisions deferred over several years – some beyond the next general election – the near-term fiscal landscape remains largely unchanged. Fiscal flexibility is set to improve, with the Chancellor projecting a buffer of approximately £22 billion, more than double last year’s level, which had been largely eroded and fuelled months of speculation over potential tax increases. While this represents a meaningful increase in fiscal headroom, it remains below average, with the typical revision to an OBR forecast over six months around £21 billion, leaving little room for error (see Figure 2).

Figure 2. Forecast headroom against fiscal room (Source: Pacific Asset Management, IfG, November 2025).

Markets responded positively to the extra fiscal headroom and the reduced risk of near-term borrowing pressures or unexpected tax adjustments. UK government bonds delivered one of their strongest budget-day performances in twenty years, reflecting renewed confidence in the fiscal outlook. Meanwhile, equity markets, which had softened amid pre-budget leaks and speculation, stabilised as investors assessed the measures as supportive of macroeconomic stability without introducing major new uncertainties.

CONCLUSION

Despite some volatility in November, global equities are on track for another strong year, with UK, European and Japanese equities outperforming the US, highlighting the benefits of international diversification. The recent weakness in technology stocks underscores the value of sector diversification, both as a risk management tool and a source of potential returns.

November’s movements reflected shifts in sentiment rather than fundamentals, illustrating how investor perceptions can drive short-term volatility. As we enter the new year, sentiment-driven risks will remain alongside structural factors such as central bank policy, inflation trends, and sector dynamics, reinforcing the importance of a diversified investment approach across geography, sectors and risk profiles.