2025 will be remembered as a year in which uncertainty and strong investment performance were not mutually exclusive. For the first time since 2019, global equities, bonds, and commodities all delivered positive returns, supported by AI-driven investment themes, central bank easing, and falling tariffs.

This headline performance, however, understates the challenges investors faced over the year. Policy and trade uncertainty dominated the news flow early on, with U.S. equities falling more than 20% in sterling terms as markets grappled with the implications of global tariff rates reaching levels not seen since the 1930s. At the same time, government balance sheets came under increased scrutiny amid fiscal largesse, while a shifting world order heightened geopolitical risks.

Equity

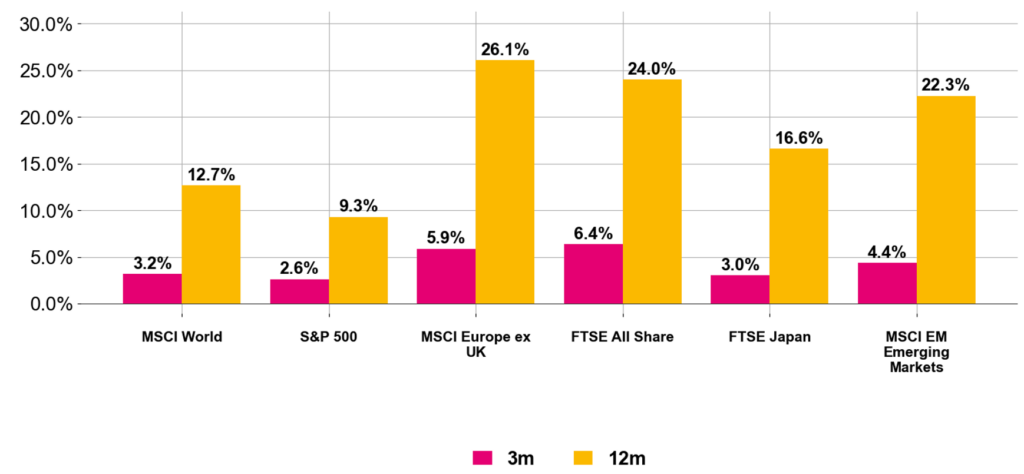

Equities reached new highs, but unlike much of the past decade, leadership did not come from the United States. Instead, investors were rewarded for adopting a more global approach, as market performance broadened beyond U.S. mega-caps into more attractively valued regions. Structural themes such as artificial intelligence and clean energy also gained traction across a wider range of geographies, reinforcing the shift toward more diversified sources of return.

European equities led global markets, delivering returns of over 26% in sterling terms. Performance was supported by a combination of attractive valuations and improving investor sentiment, as falling inflation enabled the European Central Bank to cut its deposit rate to 2%. In addition, a renewed commitment to fiscal expansion – most notably in Germany, which announced plans to allocate €500 billion to infrastructure and adopted a “whatever it takes” approach to defence spending – provided a further boost to the region.

Outside Europe, UK equities also delivered strong results, recording their fifth-best annual return since 1984. Performance was underpinned by renewed investor interest in lower-valued markets, as well as the index’s structural bias toward defensive sectors, which performed particularly well over the year.

Emerging markets, meanwhile, challenged the notion that the United States is the sole driver of equity returns. A rally in technology companies outside the U.S. supported a broader advance across emerging market equities, with particularly strong performances in China, Taiwan, and South Korea. Combined with a weakening U.S. dollar and the fact that many emerging economies carry lower debt levels and are growing faster than their developed-market peers, the outlook for the asset class remains constructive.

Figure 1: Equity Returns (Source: Pacific Asset Management, Bloomberg, January 2026)

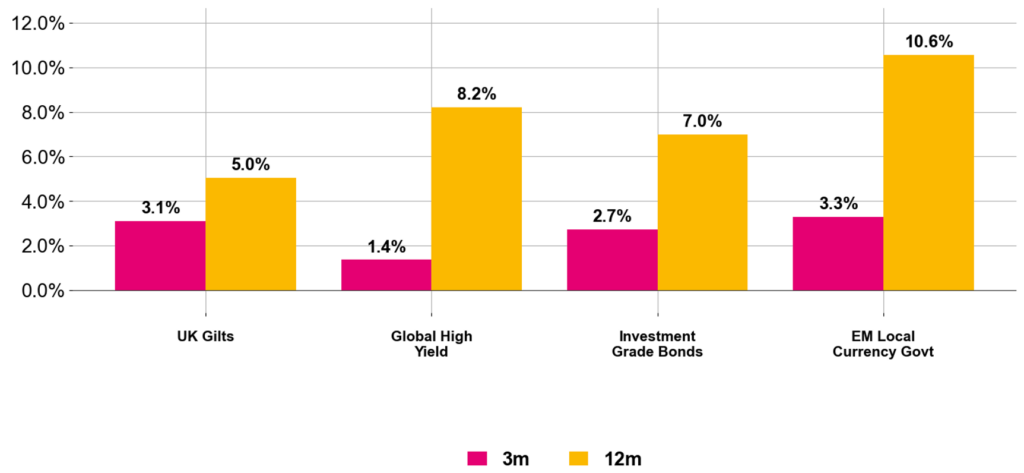

In fixed income, declining inflation and the gradual easing of monetary policy supported bond markets overall.

Interest rates fell in the UK and Europe as the Bank of England and the ECB reduced rates to their lowest levels since 2023. Meanwhile, after holding steady for much of the year, the Federal Reserve resumed its rate-cutting cycle, delivering reductions in September. This contributed to a decline in short-term rates. However, fiscal concerns continued to weigh on government bonds, leading to a steepening of yield curves across major markets as long-term yields rose.

Corporate bond spreads – the premium investors receive for holding credit risk – recovered from the widening seen in April. For much of the year, spreads narrowed amid a risk-on environment, which saw higher prices for both investment-grade and high-yield bonds.

Figure 2: Fixed Income Returns (Source: Pacific Asset Management, Bloomberg, January 2026)

Gold

Gold surged to its strongest performance in half a century, reflecting the impact of fiscal profligacy among Western governments, political uncertainty, and a weaker U.S. dollar. The safe-haven metal broke multiple records over the year, reaching $4,482 per ounce in December. Looking ahead, we expect gold prices to remain supported by ongoing central bank purchases and elevated fiscal deficits.

OUTLOOK

Continued global growth and resilient consumer demand underpin a constructive outlook for equities. However, valuations remain high in concentrated markets, and investors are increasingly cautious about the risks associated with AI-driven themes.

This environment presents opportunities as markets broaden, with previously overlooked areas likely to benefit. Thoughtful portfolio construction and rigorous risk management will be critical as emerging opportunities – and potential risks – come into focus over the year.