- Risks to US Exceptionalism: The US has been the strongest performing region, due to its higher earnings power over the past decade. Given its concentration now in the index, global indices could be overly reliant on US equities, making conventional passive approaches vulnerable to US underperformance.

- Trade Uncertainty: Trump’s tariff policies have heightened global economic and geopolitical uncertainty. Whilst the tariff rates have changed from first inception, the uncertainty around them has remained, which likely affects businesses and consumers ability to plan for the future.

- Beyond Bonds and Equities: Traditional diversification is less effective; alternatives and uncorrelated assets now play a key role.

- Tactical Diversification Essential: In today’s volatile environment, flexibility and broad diversification are critical.

Outlook

We said in January that investors need to be ready and willing to turn away from the bright lights of the US. Those lights have dimmed in the last few months. At the time, we pointed out the high expectations built into share prices in the US. This had been partly justified by superior earnings growth, but ever higher valuations made the US susceptible to any disappointment. Since then, we have seen one of the largest regional rotations in history, followed by a sell-off in equities more broadly. In the first quarter of the year, the US fell 7.2% whilst the world (ex US) rose 3%. It’s tempting to think that portfolios that allocate to a global tracker fund are highly diversified, and of course, they are when you count the number of individual stocks. However, the size of the allocation to the US is such that it dominates performance; in Q1 the equity markets of most countries rose, but the world index fell over 4% under the weight of the US.

Of course, some would say that interfering with the weighting of a global tracker fund that is based on market capitalisation is taking an active decision and that passive always wins. We believe that it is possible to add value tactically, but more importantly, the risk of a global tracker fund, in terms of concentration has never been higher. Any index that has over 70% in any region is obviously vulnerable to that allocation disappointing. The US has outperformed for so long that some investors believe that US outperformance is the natural way of things. We still believe that US exceptionalism is not a given. Early in Q1 we moved a significant part of our portfolios away from the US into other equity markets where expectations, and therefore valuations are much lower.

The Fog of (a trade) War

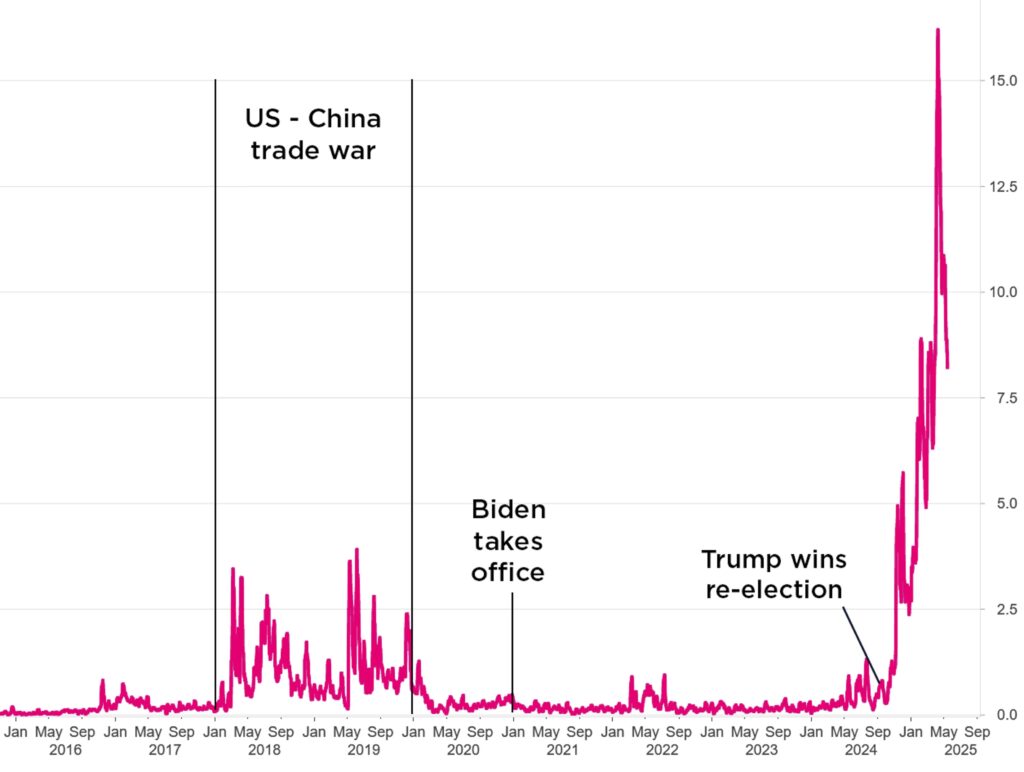

At the start of April, Trump announced a sweeping package of reciprocal tariffs, which his team branded as ‘Liberation Day’. We had previously characterised Trump’s second-term strategy with the phrase ‘uncertainty everywhere’. It was our view that across his five key policy pillars – Tariffs, Immigration, Tax Cuts, Spending Cuts and Deregulation – we expected a more aggressive approach. Unlike in his first term, we believed Trump would lead with tariffs, given his ability to do so via executive order. The chart below shows Bloomberg’s Economics Global Trade Policy Uncertainty Index which shows a sharp spike since the start of Trump’s second term. The elevated uncertainty has made it increasingly difficult for both businesses and consumers to plan their spending.

What took markets by surprise was not only the scale of the ‘Liberation Day’ tariffs, but also their broad application and apparent disconnect from the specific tariff and non-tariff barriers of each trading partner. Early estimates suggested the tariffs could reduce U.S. GDP by 3% and push inflation up by 1.8% — a stagflationary combination that could tip the economy into recession.

Bloomberg Economics Global Trade Policy Uncertainty Index

Source: Macrobond, 2025

Since the announcement, Trump has partially reversed course. He first paused implementation, then secured a deal with the UK, and finally scaled back tariffs on Chinese goods. These moves appear to have been driven partly by equity market volatility, but more significantly by rising bond yields and declining public approval of his economic policies. Despite these adjustments, the US is likely to be viewed as an unreliable partner in trade and security. Even close allies have publicly criticised recent actions. This is evident in Prime Minister Carney’s remarks on US–Canada relations, and Germany’s announcement of a comprehensive new defence initiative.

Building Portfolios for an Uncertain World

The landscape has changed beyond recognition since the start of the year, with uncertainty close to record levels. The natural defence against uncertainty is diversification, and as multi-asset investors, we think that it’s important to diversify across asset classes as well as geographies. For the first twenty years of this century, bonds provided the perfect offset to equities: they generated a positive return and rode to the rescue when equities fell. That all changed with the pick-up in inflation and investors who relied solely on fixed income to diversify their portfolios wished they hadn’t in 2022 when equities and bonds fell together. Of course, government bond yields starting at the lowest level in human history made them particularly poor shock absorbers for portfolios.

Roll forward to today and government bond yields are significantly higher than they were, and so future returns have improved. However, the correlation between equities and bonds remains elevated. And so just when portfolios need an offset to falling equity markets, investors have once again found that bonds aren’t the diversifiers that they once were. We have taken advantage of our unitised structure as part of our core portfolios to have additional layers of diversification to help solve this problem. We have two additional sources of diversification: firstly, we have a structural allocation to diversifying assets, strategies that are uncorrelated with equities and fixed income. These strategies typically enjoy a tailwind of higher interest rates plus any alpha on top. Those that were disappointed by liquid alternative strategies in 2010s should go back, add today’s interest rate on top, and see how they stack up. It’s important to keep costs low – we do this by running some of these strategies in house. Secondly, we allocate tactically to alternatives, such as commodities, gold, listed real estate and infrastructure. These are sometimes incredible diversifiers but need to be used more tactically and sized correctly. In the first quarter, all four asset classes: equities, fixed income, diversifying assets and alternatives generated positive performance in our core portfolios. We suspect that we’re all going to need as much diversification as possible for the rest of the year.

CONCLUSION

Trump’s trade war may ultimately be short-lived — a reflection of his strategy to escalate tensions in order to force negotiations. However, it also underscores a deeper issue: the growing perception among close allies that the US is no longer a consistently reliable partner across key areas of policy. In this environment, capital may increasingly flow away from US markets, ushering in an era of financial protectionism. For multi-asset investors navigating this environment of heightened volatility, maintaining diversification and adopting a tactical approach are likely to be essential to weather the ongoing uncertainty.