After a strong May and June, July proved to be another constructive month for risk assets as markets responded favourably to easing trade tensions, robust corporate earnings, and greater fiscal clarity – despite lingering concerns around interest rates and government borrowing.

One of the key macro developments came from the United States, where the “One Big Beautiful Bill Act” was passed. The bill outlines front-loaded tax cuts paired with long-term spending reductions, signalling a more expansionary fiscal stance. While the initial market reaction included a sell-off in Treasuries as investors digested the long-term implications for debt, equities rallied as the bill was seen as reducing short-term political and economic uncertainty.

Markets also welcomed progress on trade. Although the temporary pause on reciprocal tariffs between the U.S. and China is set to expire in early August, July brought signs of cooperation. Renewed trade dialogues with Japan, Vietnam and the EU supported risk sentiment.

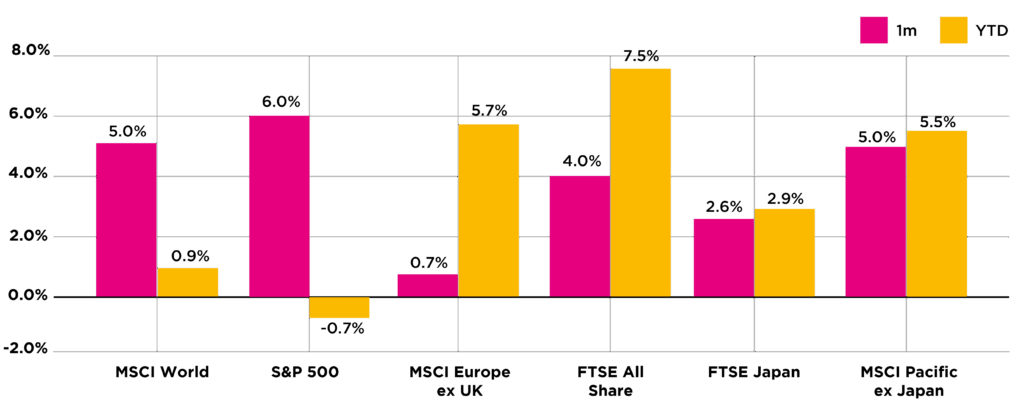

Regional equity returns

Figure 1. Regional equity returns (Source: Pacific Asset Management, July 2025).

Equities continued their upward march. Global developed markets rose by 5% in July (in sterling terms), with U.S. stocks once again leading the way. The S&P 500 reached new highs as nearly 80% of reporting companies exceeded both earnings and revenue expectations for Q2. The so-called “Magnificent 7” tech giants continued to outperform, though strength was also seen in cyclicals and financials. UK equities benefited from a rally in energy and materials companies, which continue to trade on low valuations. Notably, both BP and Shell saw gains over the month. At the same time, signs of a revival in the Chinese economy – driven by improving activity and ongoing policy support – boosted Chinese equities and supported broader Emerging Market performance.

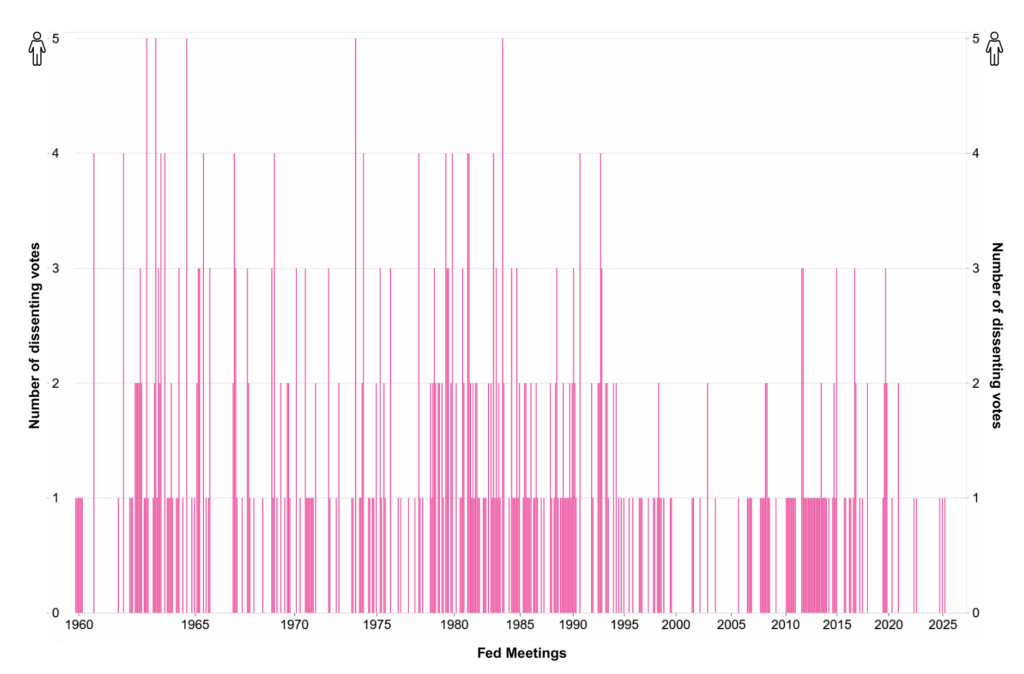

Bond markets were more mixed. U.S. Treasury yields rose again as investors grappled with an uncertain inflation outlook and reassessed the likelihood of interest rate cuts in light of fresh fiscal stimulus. This debate played out publicly within the Federal Reserve, which elected to keep rates on hold despite two Governors – Bowman and Waller – dissenting and voting for a cut, marking the first dual dissent since 1993 (see Figure 2.).

Federal Reserve voting record: Number of dissents

Figure 2. Federal Reserve voting record: Number of dissents (Source: Pacific Asset Management, July 2025).

European yields also edged higher while U.K. gilts came under pressure following a hotter-than-expected inflation print, with core CPI rising to 3.7%. In Japan, 10-year government bond yields reached 1.6%, the highest level in years, as markets priced in sticky inflation and growing political uncertainty. Credit markets held up better, with corporate bond spreads tightening as investors continued to favour quality credit over sovereign exposure.

As we head into the latter part of the year, investor sentiment appears cautiously constructive. The strong performance of risk assets over recent months has been underpinned by solid earnings, stable economic data, and improving global trade dynamics. However, with equity markets pricing in a relatively optimistic outlook, the bar for positive surprises is getting higher.

At the same time inflation remains sticky in several regions, and bond markets are signalling unease around long-term fiscal trajectories, particularly in the U.S. and Japan. Against this backdrop, much will depend on whether central banks can successfully navigate a soft landing – easing rates without reigniting inflation – or whether tighter financial conditions resurface as a drag on growth.

For now, markets appear to be giving the benefit of the doubt, but investors should remain alert to shifting policy signals and broader economic trends in the months ahead.