- Markets regained momentum in Q3, supported by resilient earnings and a soft-landing backdrop despite persistent headline uncertainty.

- Fed rate cuts signal a shift toward supporting growth, with concerns around the labour market outweighing inflation. This creates favourable conditions for risk assets, as long as a recession is avoided.

- AI investment is surging, with hyperscalers spending around $300bn annually on data centres. It remains to be seen whether these investments will deliver a return on equity investment, however this arms race will benefit the builders of these projects.

- Positioning targets undervalued AI-linked areas – clean energy, Chinese tech and investment trusts – while maintaining diversification.

OUTLOOK

After a volatile start to the year, markets regained their footing, with the third quarter characterised by strong returns. Despite a barrage of negative headlines, ranging from tariff uncertainty to Trump’s persistent attacks on Federal Reserve independence, risk assets have continued to perform, leading many to question whether markets can continue to climb this ‘wall of worry’. But the reality is that this year, outside of Trump’s manic week of tariff announcements, equities have been supported by resilient earnings and a soft-landing macro backdrop.

US Real GDP growth has moderated to around 2%, down from the globally exceptional c3% in 2024, but remains supportive of risk assets. Part of this continued growth is due to the increase in capital expenditures due to data centre build-outs. We believe this will continue, and our positioning to look to benefit from this theme is discussed in detail in this piece. Labour market data shows signs of softening, with slower job creation and a gradual rise in unemployment, driven by lower immigration, and policy uncertainty, but widescale layoffs are not happening yet. Inflation remains above target, with US services inflation, which tends to be particularly sticky, normalising towards 3%, whilst goods have moved from outright deflation to positive on the back of tariff passthrough.

Central banks have responded to this data with rate cuts, including the Fed’s September move, signalling a shift in focus from inflation to employment risks. This was characterised by Powell as a ”risk management cut”, emphasising the view that whilst the current policy rate was restrictive, they would like to move before any growth slowdown takes place. It is likely that the Fed will continue to cut rates towards the end of the year and through 2026 barring a return of inflation. We know from history that cutting cycles that happen without a recession lead to potent conditions for market returns, and in some cases these cuts have been one of the ingredients in the making of bubbles.

AI: A Transformational Theme

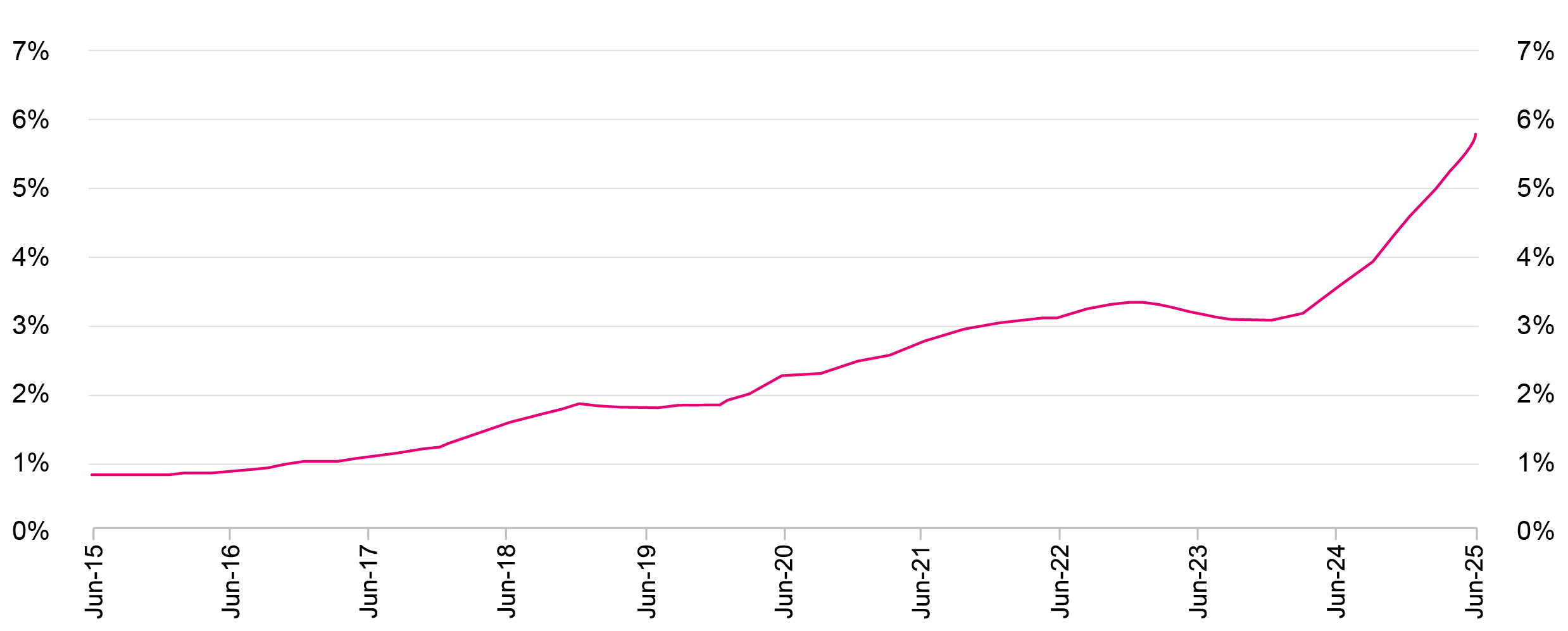

AI continues to dominate market narratives, with hyperscalers committing unprecedented capital to data centre build-outs. Capex from the Magnificent Seven alone now accounts for over 30% of S&P 500 investment, with spending reaching 60% of the operating cash flow of these businesses. On an annualised basis, these companies are due to spend $300bn on data centres. The scale of these projects is immense, with Meta’s Louisiana data centre occupying a space of around 4 million square feet, requiring 5,000 construction workers to build it and demanding the power of a city like Seattle for it to run.

This arms race is driving growth, but for this vast investment to prove worthwhile there needs to be a return on capital of these investments. Whilst AI is already impacting productivity and day-to-day work, it remains to be seen whether these investments will prove worthwhile. Another concern relates to the circular financing deals that are becoming a more frequent feature of this investment, which could fuel potential exuberance. We remain constructive on the theme but are focused on accessing it through less crowded, lower-valuation opportunities.

AI Capex running at $300bn annualised

To us three areas stand out:

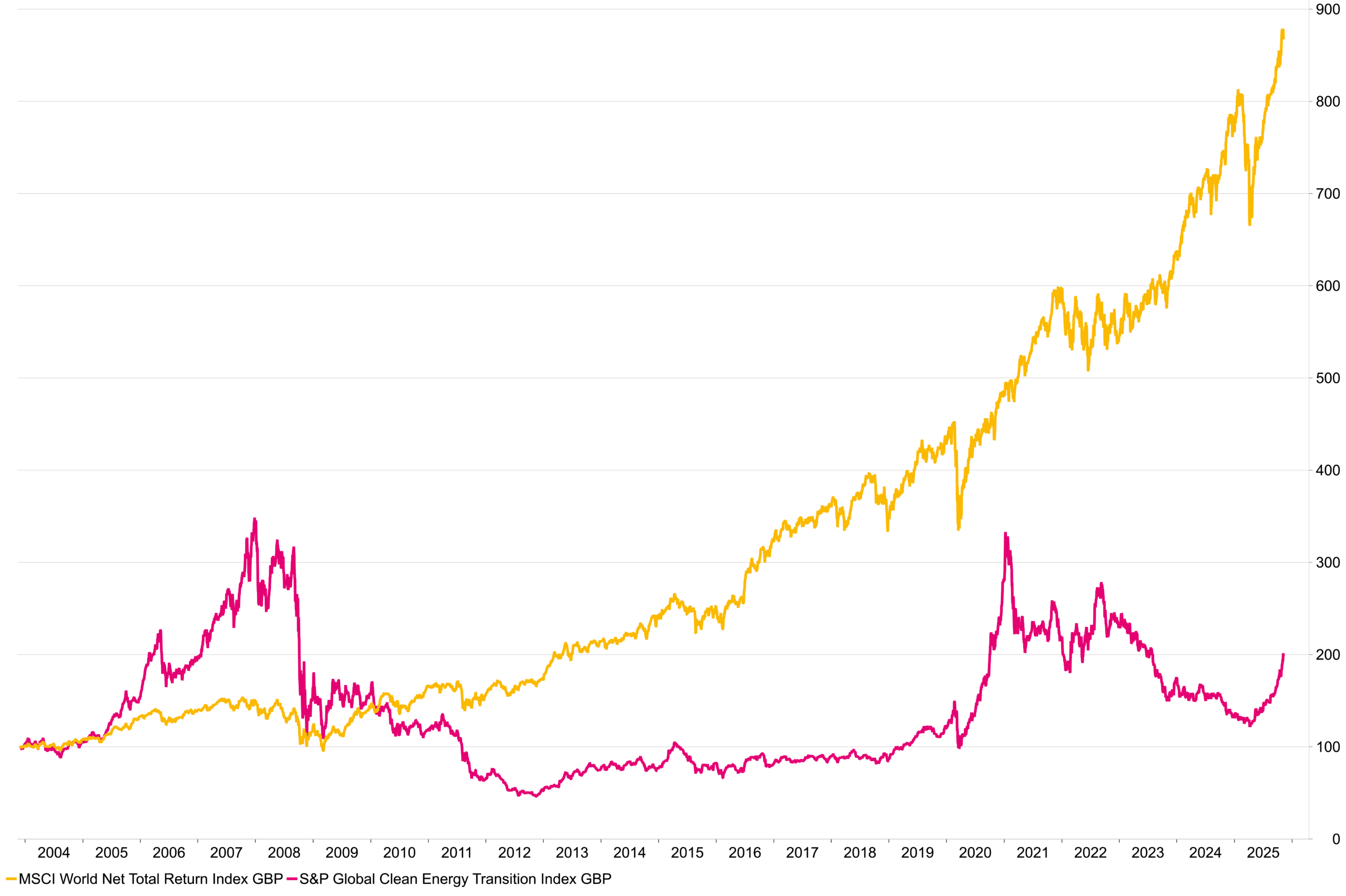

Clean Energy: Data centres require vast energy inputs, and have shifted the supply and demand balance for energy in the US. Clean energy is both cheaper and faster to deploy than traditional sources. The iShares Global Clean Energy ETF offers exposure to this critical infrastructure at a discount to global equities. Despite being a maturing technology, clean energy is now the largest energy source globally and is experiencing renewed momentum. Clean energy has been a hot theme before, firstly in the mid-2000s when the technology was nascent it experienced a pre-profits bubble. The rally in 2020-2021 was short lived too, as rate hikes and lacklustre economic growth threatened many infrastructure projects. But now we believe that clean energy sits in a unique spot. The emergence of data centres causes an increased demand driver, and the economics of solar and wind, combined with battery storage, make them the preferred choice for powering AI infrastructure.

Global Clean Energy stocks and MSCI World

Chinese Technology: Emerging markets have begun to reassert themselves, benefitting from a weaker dollar and more conventional monetary and fiscal policy. Valuations remain attractive, and earnings growth is improving as capital allocation becomes more disciplined. China’s tech giants offer comparable innovation to US peers, with exposure to AI, cloud, chips, and EVs. Companies like Baidu, Alibaba and Tencent are developing competitive LLMs and AI software, often with greater efficiency due to a lack of access to cutting edge Nvidia chips. Despite geopolitical concerns, these firms continue to grow and innovate, serving vast domestic markets. Valuations remain significantly lower than those of US counterparts, providing asymmetric upside in our view.

Investment Trusts: Vehicles like RIT Capital Partners provide access to private AI leaders such as OpenAI, Wiz, and Scale at a discount. With the trust trading at a ~30% discount to NAV at time of writing and recent realisations at a premium, we think this offers a compelling route to long-term growth themes. The endowment-style approach seeks to combine public and private equity with uncorrelated strategies, offering diversified exposure to transformational technologies. Our engagement with management and the board to buy back shares is also a powerful tool investment trusts can deploy, boosting the net asset value and closing the discount.

RIT Capital Price, Net Asset Value and Discount

CONCLUSION

Despite unsettling headlines, markets continue to be driven by fundamentals, which have been strong so far this year. The resilience of corporate profitability, combined with supportive monetary policy, has created a favourable environment for risk assets. There is an increasing possibility that the combination of Fed cuts, combined with a transformation theme such as AI could develop into an equity market bubble. However, we feel that capital expenditure on data centres is real over the next few years and therefore positioning to this via undervalued and so far under owned themes is important.

Diversification across asset classes and geographies remains essential. Our positioning reflects a balance between participating in transformational growth and managing downside risks. We believe this approach offers resilience and upside in an uncertain world.