Outlook Snapshot

- 2023 will be remembered as the year when the importance of biodiversity was recognised by the world, following the COP15 summit at the end of 2022.

Biodiversity in 2023

When discussing sustainability, 2023 has been the year for biodiversity so far, mainly due to the big push

caused by the ambitious targets set during the most relevant international biodiversity summit, COP15,

at the end of 2022. Biodiversity broadly refers to forests, oceans and other natural ecosystems, and the

plants and animals that make them up. These complex habitats form a vital part of the fight against

climate change. Within investment, the concept of biodiversity attempts to put an economic value on

these habitats and attempts to judge how well countries and companies are considering these impacts

in their value chain.

COP15: Setting New Biodiversity Targets

Countries meeting for COP15 – the equivalent of the climate COP meetings yet linked to the Convention

on Biological Diversity (CBD) – sat down to agree on a new post-2020 global biodiversity framework

following the unsuccessful pursuit towards meeting the 2020 Aichi targets adopted in 2010. Policymakers

and negotiators from 188 countries set out a specific plan to reduce biodiversity loss, including a landmark

agreement to protect 30% of land, oceans and degraded ecosystems by 2030, also known as the “30

by 30 agreement”. This has aided nature protection and restoration to take a centre-stage role within

the ESG space alongside climate change. However, it possesses a unique advantage: biodiversity is a

topic of consensus across the political spectrum. During this tumultuous and polarised era surrounding

responsible investments, especially in the US, investing in biodiversity has been proven to be a more

unifying element.

The Alarming State of Global Biodiversity

Nevertheless, the current condition of biodiversity is dire. According to the latest Living Planet Report,

wildlife populations have plummeted by 69% on average since 1970. Some scientists also argue that we have entered what is now the Sixth Mass Extinction. There have been efforts to attempt to quantify the value of natural processes on global economies for some time, of course these should be taken with a pinch of salt but still inform us of the scale of the issue.

Economic Implications of Biodiversity Loss

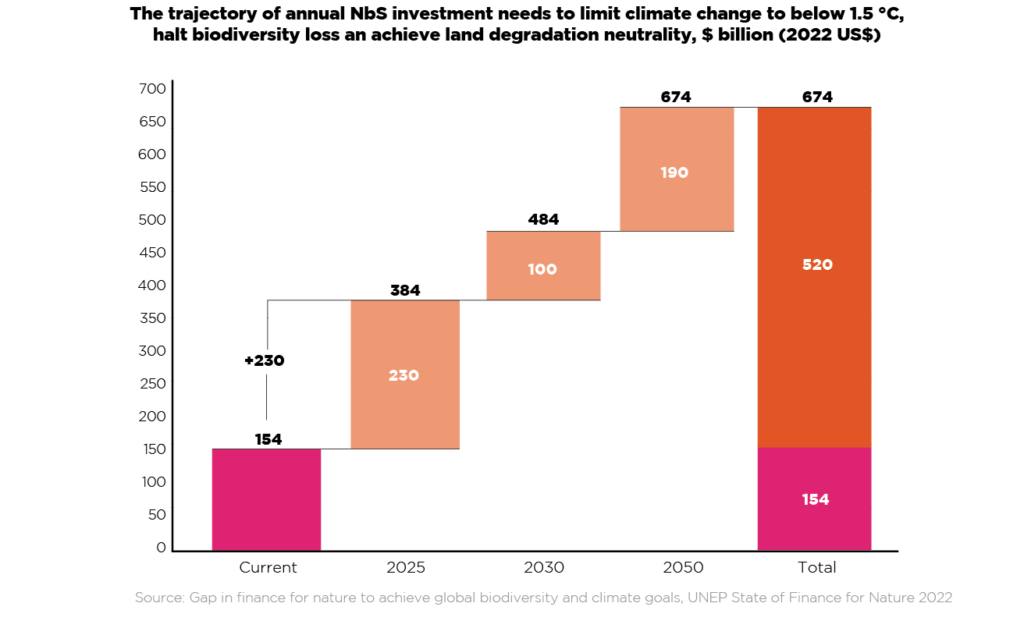

With approximately $44 trillion of economic value moderately or highly dependent on nature, a constant trend of biodiversity loss could trigger dire economic consequences. Ecosystem services delivered by nature, including crop pollination, water purification and others are globally worth an estimated USD$125-140 trillion per year, or 1.5 times global GDP. The United Nations Environment Programme estimates that current finance flows to Nature based Solutions (NbS) are less than half of those needed by 2025. In particular, private sector investment should be increased by several orders of magnitude from current levels, estimated at US$26bn per year. Focus should be set in greening corporate supply chains, including materialising and increasing financial flows to the fulfilment of net zero deforestation pledges. If these financial goals were to be achieved, it would tackle three problems simultaneously: increased carbon sequestration by natural ecosystems could help achieve climate goals; biodiversity loss could be reduced; and halting land degradation and increasing restoration could be achieved.

Investment Strategies For Biodiversity Preservation

In this context, investors must start-off by increasing their awareness of their impacts on biodiversity loss, setting an initial layer for further commitments and action. These should impact investment allocation, ensuring that biodiversity related risks and opportunities are being assessed. For example, companies can establish exclusionary screens on certain companies and sectors with high impact, such as mining or oil & gas. Stewardship activities should increasingly tackle biodiversity topics, addressing issues such as deforestation or voting for resolutions that aim to decrease a company’s impact on nature. Setting industry specific KPIs can help prioritise investment in the direction of “improvers”. A growing number of tools, such as ENCORE , can help us in the identification of the underlying impacts of certain sectors and their dependencies on ecosystem services, further aiding in this process.

Challenges

Nevertheless, in similar fashion to what happens around climate change action, accurate and meaningful data on biodiversity impacts is still hard to source from investees. Adequate engagement with companies and a harmonisation of disclosures in the medium-term would help tackle this issue, further increasing the need to incorporate this topic into day-to-day stewardship efforts.

Energy Frameworks For Biodiversity Reporting

Following this line of thinking, different international frameworks have begun to pave the way for biodiversity reporting. For example, the Task Force on Nature-Related Financial Disclosures (TNFD) was published this September to guide firms governance, reporting and integration of biodiversity related information into firms activities. It follows the same structure as its sister framework, the TCFD, on climate-related disclosures. Its increasing adoption can help guide investors in what is expected of them, as well as increasing availability of data across investee companies. Furthermore, the PRI is also heading in this direction, with recent news suggesting that future reporting frameworks may foster engagement with companies with high biodiversity impacts such as forest loss or land degradation with presence in emerging markets. Until that stage is reached, the UN-backed organisation is pushing for collaborative efforts to reduce companies’ negative impacts on forestry and land degradation, which are prioritised as the primary drivers of biodiversity loss.

Conclusion

It is still very early days in the consideration of biodiversity within investment decision making. Very few companies specifically address issues such as deforestation and land degradation, regardless of industry. However, it appears as though both the investment community and regulators are increasingly putting in place frameworks to better understand companies’ views on the issue. This brings another framework to assess companies’ performance, which may help mitigate some of the recent criticism on using simple ESG scores to make investment decisions.