- After a volatile spring, equity markets have rallied. Looking forward though risks remain, making diversification key.

- US growth is slowing and labour markets are cooling, but overall the economy is not yet at stall speed. The Fed’s recent pronouncements mean rate-cuts are likely, which may pressure the dollar.

- Emerging markets, long underperforming due to share dilution and volatility, now show improving EPS alignment and more attractive valuations.

- With the US dollar weakening, earnings picking up and valuations low, Chinese technology offer attractive opportunities for returns.

OUTLOOK

After the Trump-induced roller coaster ride in the spring, equity markets have regained their poise, and the late summer has been more like a slow ascent on a Ferris wheel. Whilst we don’t expect a trip to the house of horrors, there may still be some market jitters before the year is over; diversification remains important.

This year has seen dramatic changes not only in market performance, but also in terms of market leadership. In the first quarter, it was Europe that led the way, driven by fiscal stimulus from Germany and increased collaboration on defence spending. Then came ‘Liberation Day’ and subsequent trade deals, which caused a sharp sell-off before a rapid recovery. In this most recent phase, investors have returned to the themes we saw in 2024, with AI stocks, particularly focused on US mega-cap names, outperforming.

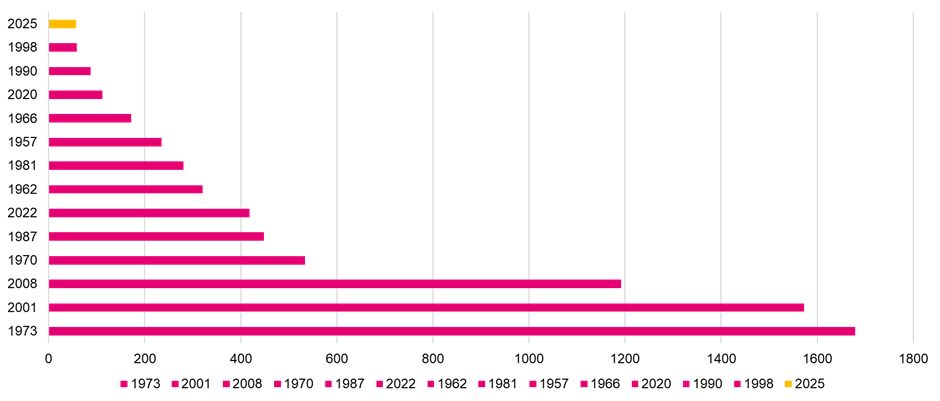

The fastest rally back to an all-time high after a 20% fall for the S&P500

Although many trade deals have been announced, it remains to be seen how the US economy will fare in terms of both growth and inflation. So far this year, we have seen a normalisation of GDP, averaging 1.2% over the first half of the year, lower than the 2.8% average of 2024. Some of this slowdown is attributed to a weaker consumer spending after a period of tariff front loading. We have also seen signs of cooling in the labour market, where hiring is slowing, with revisions showing the rate of job creation has been lower than thought. However, despite these revisions to labour market data and a slower growth outlook, the economy is not yet at stall speed.

Chair Powell of the US Federal Reserve acknowledged that “the risks to inflation are tilted to the upside, and risks to employment to the downside – a challenging situation”. However, the FOMC judges that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” This willingness to cut interest rates despite inflation above target is likely to put further pressure on the dollar. While this backdrop presents a risk to US exceptionalism, it also creates opportunities.

Opportunities

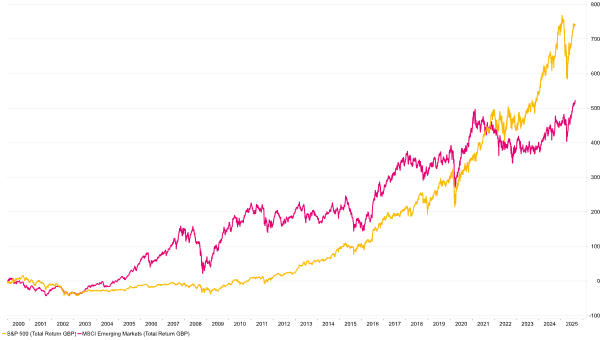

For those investors that experienced the 2000s, emerging markets will always have a place in their hearts. Remember, the S&P 500 lost money over the decade, and investors had to endure two heart-stopping bear markets. Meanwhile, emerging market equities more than doubled in sterling terms, although volatility has always been a feature of emerging market investing, both in good and bad times.

US Equities have not always outperformed Emerging Markets equities

Of course, that feels like ancient history, as the S&P has left EM equities in the dust over the last fifteen years. Since the glory years, EM equities have had considerably more volatility but has only rewarded investors with a fraction of the returns of the US stock market; not the risk-return relationship that students of investing learnt about at school.

There has been one issue that has blighted EM returns over the period: the weak linkage between GDP growth and earnings growth. The worst offender has been China: its GDP has grown over fivefold since 2007, whilst earnings per share have only doubled.

Why is this? Well, it’s not that Chinese companies haven’t grown their profits. Over the last 50 years, almost nowhere has seen faster profit growth: over 20% a year. But what matters for investors is earnings per share (EPS). If companies issue shares prolifically, as they have in China, then profits to shareholders are significantly diluted. EPS have grown by less than 5% per annum over the same period. Now you can see one of the reasons for the lack of linkage between GDP growth and stock markets. By contrast, US companies have been buying back shares, increasing EPS and fully capturing profit growth.

In the high-growth years for emerging market economies, companies’ investment spending soared, often resulting in misallocated capital and a tidal wave of share issuance. However, in recent years, investment spending has become much more controlled and, as a result, share dilution is much lower and closer to levels in developed markets. As a result, earnings growth and EPS growth are finally becoming more aligned.

So where are the opportunities today?

Firstly, as the battle rages on between active and passive, when it comes to emerging markets, even a dyed in the wool passive investor should think carefully before assuming that passive is always the answer. The evidence shows that emerging markets are different. Multiple studies have shown that the average active manager outperforms. Pacific North of South Capital have shown that it’s possible not just to outperform, but to do so consistently. In fact, they have managed to do so seven years in a row. If outperformance were purely based on luck, then this would be like tossing seven heads in a row – a probability of 1 in 128. Not likely.

We also think it’s possible to add value by tactically allocating to areas of opportunity. We might express this through a passive vehicle – a classic example of where “passive” investing is really anything but passive. For us, this includes a position in Hong Kong-listed technology companies. These companies have many of the advantages of their US technology cousins, fast earnings growth, AI advancements, and yet trade at very attractive valuations, a combination we want to have exposure to.

No market is as great as it seems or as poor as it has been. When emerging market equities were in vogue, they traded at a valuation premium to developed markets, such was the enthusiasm about their prospects. Today they trade at nearly a 40% discount. But it’s the improved outlook for their earnings per share that makes them attractive again. Moreover, the weakening US dollar has historically been a tailwind for emerging markets: since 1972, US stocks have averaged 6.8% annual returns in a depreciating dollar environment, whilst EM equities have returned a remarkable 21.7% annual return.