Continued enthusiasm around AI, coupled with news of a trade agreement between the US and China – under which the US reduced tariffs and Beijing eased restrictions on rare earth exports – helped drive global equities higher for the second consecutive month.

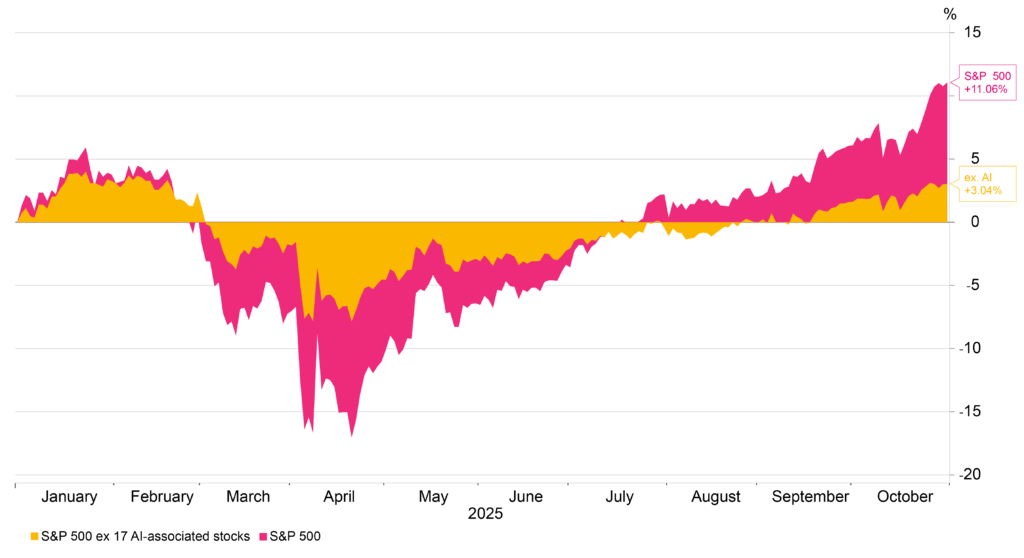

Developed market equities led the gains, with US stocks rising 4.9% in sterling terms as large-cap names once again outperformed mid-caps. This highlights the growing concentration and dependence on a handful of AI-related companies, with the index up 11% year to date, but a more modest 3% when those firms are excluded (see Figure 1.).

Figure 1. US Equities vs US Equity ex AI companies (Source: Pacific Asset Management, October 2025).

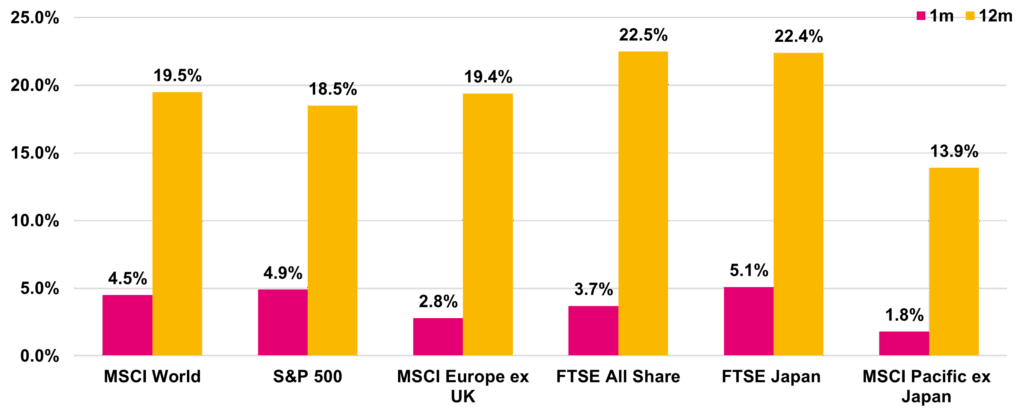

Outside the US, Japan was the standout performer, with equities rallying over 5% as the market benefited from enthusiasm around AI and the appointment of Sanae Takaichi – the country’s first female prime minister. Her policy stance, aligned with Abenomics, led investors to price in further fiscal expansion and a weaker yen, which supported Japan’s exporters. Meanwhile, UK equities rose 3.7%, aided by a softer sterling that boosted overseas earnings for exporters, while commodity and mining stocks advanced on the back of higher commodity prices, particularly in precious metals.

Figure 2. Regional equity returns (Source: Pacific Asset Management, October 2025).

In fixed income markets, developed market government bonds posted positive returns.

UK gilts led the gains, returning nearly 3% last month, as September’s inflation print of 3.8% came in below market expectations of 4%, prompting investors to bring forward interest rate cut expectations. This view was further reinforced by speculation around the upcoming budget, with the Treasury expected to raise additional revenue through tax increases, which is likely to weigh on growth prospects.

In the US, Treasuries posted positive returns last month, supported by concerns over the government shutdown and the collapse of First Brands and TriColor. The Federal Reserve cut interest rates by a quarter point, bringing rates to their lowest level in three years, which initially boosted the market. However, some of these gains were pared back following Chair Powell’s more hawkish rhetoric, which cast doubt on a December rate cut. The decision also saw duelling dissents for the first time since 2019, with Miran advocating a further cut and Schmid voting to keep rates unchanged.

Turning to corporate bonds, spreads in both Investment Grade and High Yield bonds widened modestly, but with all-in yields remaining high, returns were still positive. Technical conditions also remain supportive, highlighted by Meta’s $30 bn debt issuance the largest since 2023 – which attracted over $125 bn in investor orders.

Looking ahead, debt issuance from technology companies is expected to pick-up. Morgan Stanley estimates that of the $3tn planned for data centre investment through 2028, roughly half will be financed via debt.

The theme of AI-driven capital expenditure is expected to continue and accelerate into 2026, keeping investors focused on both the opportunities and the surrounding hype. One debate that is likely to continue is whether the Magnificent 7 can maintain their ‘magnificent’ status if significant portions of their vast cash reserves are devoted to AI investment, potentially weighing on margins and testing the premium investors have historically been willing to pay.

In this environment, we continue to advise that diversification remains an investor’s best tool – not only for risk management, which is crucial, but also to capture opportunities arising from the widening gap between valuations and underlying fundamentals.