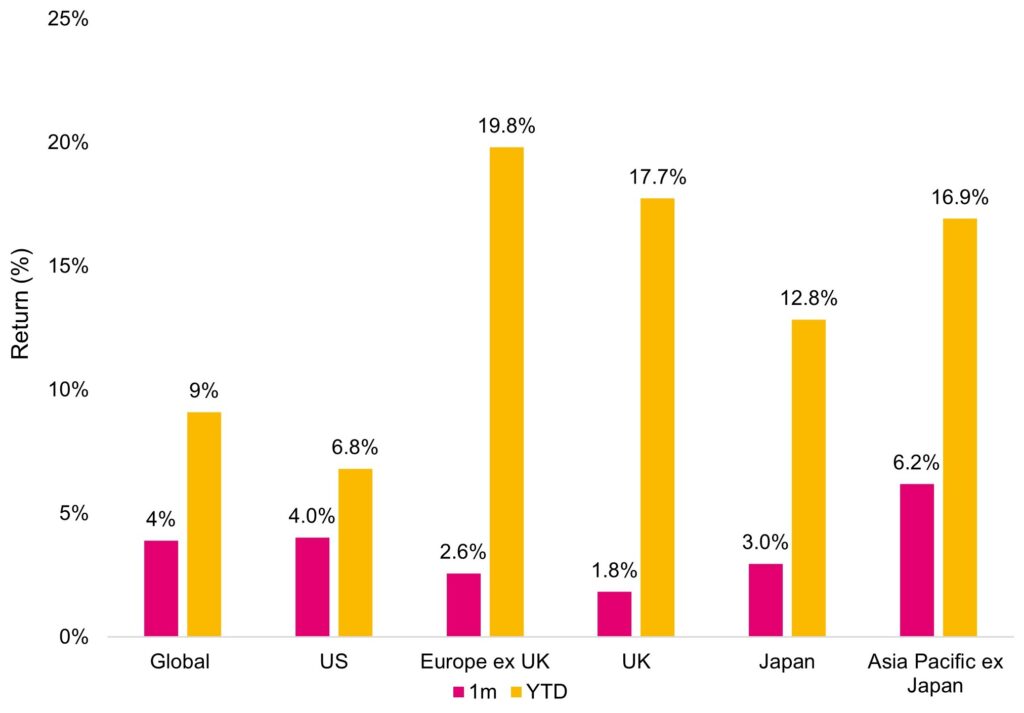

Global equities moved higher last month, with most major indices making positive returns and US equities leading the way returning 4% (in sterling terms). This meant it was another strong quarter for risk assets as enthusiasm around AI gained momentum, trade tensions were eased, and we saw the Federal Reserve cut rates for the first time since December of last year.

Regional equity returns

Figure 1. Regional equity returns (Source: Pacific Asset Management, September 2025).

Much has been made about the AI theme in recent weeks as investors contemplate whether we are entering a golden age of heightened productivity, or whether the NVIDIA circular economy which sees the company invest or lend money to companies who in return use NVIDIA GPU’s, may be creating an inflated perception of the demand for AI.

This creates an innovators dilemma for Corporate America, where if they do not embrace new technology, they would risk losing their competitiveness. Think Blockbuster dismissing streaming as being too expensive and instead continuing to focus on their bricks and mortar model.

The fear of being left behind has seen management teams at US technology companies adopt a cavalier approach with Mark Zuckerberg (CEO of Meta) expressing that misspending a couple of hundred of billion in the US would be ‘unfortunate’ but ‘the risk is higher on the other side’. Similar comments have been made by Larry Ellison of Oracle and Sundar Pichai of Alphabet.

The ability to invest billions of dollars in projects with uncertain returns has been made possible only by the exceptional financial strength of leading US technology companies. Simply put, few firms have the scale or resilience to take such risks. In today’s market – where investors are rewarding companies viewed as enablers and beneficiaries of the emerging AI economy – this dynamic has led to a renewed period of narrow leadership, with a small group of companies driving the majority of returns.

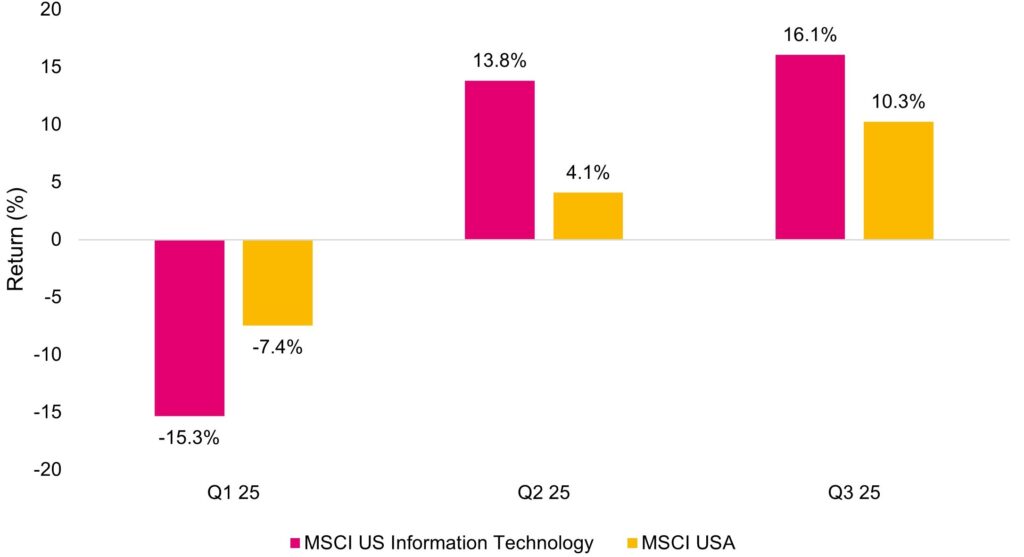

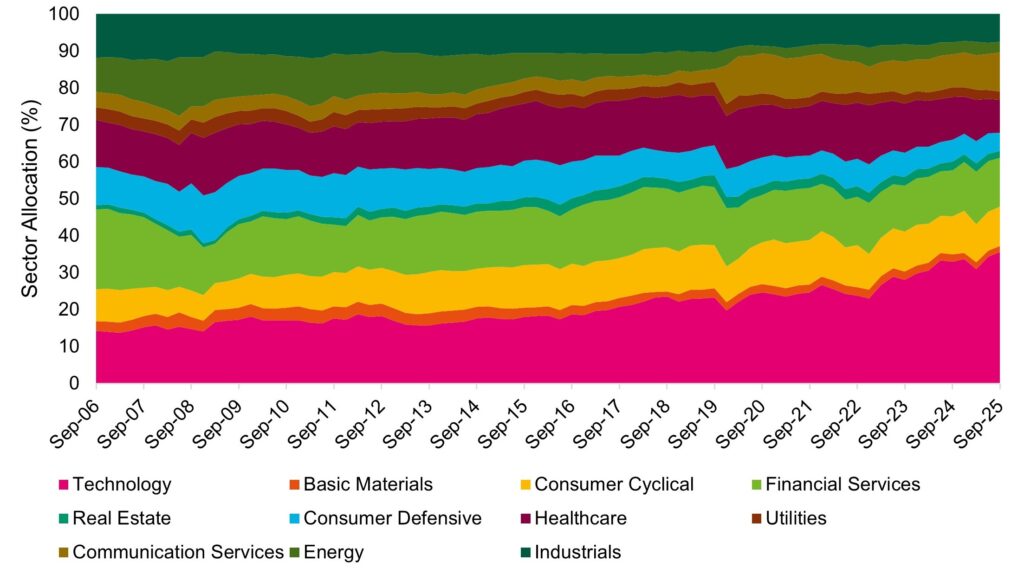

This can be seen when we look at the returns of US Technology companies which after a challenging start to the year have returned over 30% since April compared to the 14% return of the broader market. Meanwhile technology companies as a share of the US equity market have more than doubled to 35% from the 15% in September 2006.

Returns of US Mega Cap companies

Figure 2. Returns of US Mega Cap companies (Source: Pacific Asset Management, September 2025).

US Equity Market: Sector composition

Figure 3. US Equity Market: Sector composition (Source: Pacific Asset Management, September 2025).

This combination of enthusiasm, unprecedented level of spending and market moves have raised the inevitable question of valuations and whether we are in a financial bubble. The challenge lies in that bubbles in markets are only known after the fact – one person’s richly valued stock is another’s growth company of the future.

What is worth noting, however, is that there are several ways to gain exposure to the AI theme beyond simply buying US technology companies. Chinese technology firms, for instance, which trade at significantly lower valuations than their US counterparts, rose 12.6% last month. Meanwhile, sectors such as clean energy – which will form critical infrastructure in an AI-driven world – could also present attractive opportunities for investors.

This challenges the conventional view that the US is the only game in town. Technology companies outside the US have contributed to a broader rally in emerging market equities, with particularly strong returns in China, Taiwan, and South Korea. Combined with a weakening dollar and lower debt levels relative to their developed-market peers – the average debt-to-GDP ratio stands at 75% for emerging markets versus 110% for developed markets – the outlook for these economies remains constructive.

September’s market developments highlight both the opportunities and risks in a market driven by AI and concentrated leadership in US technology. While US tech companies continue to lead returns, attractive opportunities are also emerging in international markets. Investors are reminded that growth is not confined to the US and maintaining regional diversification allows for not just diversification but also capturing new and emerging opportunities.