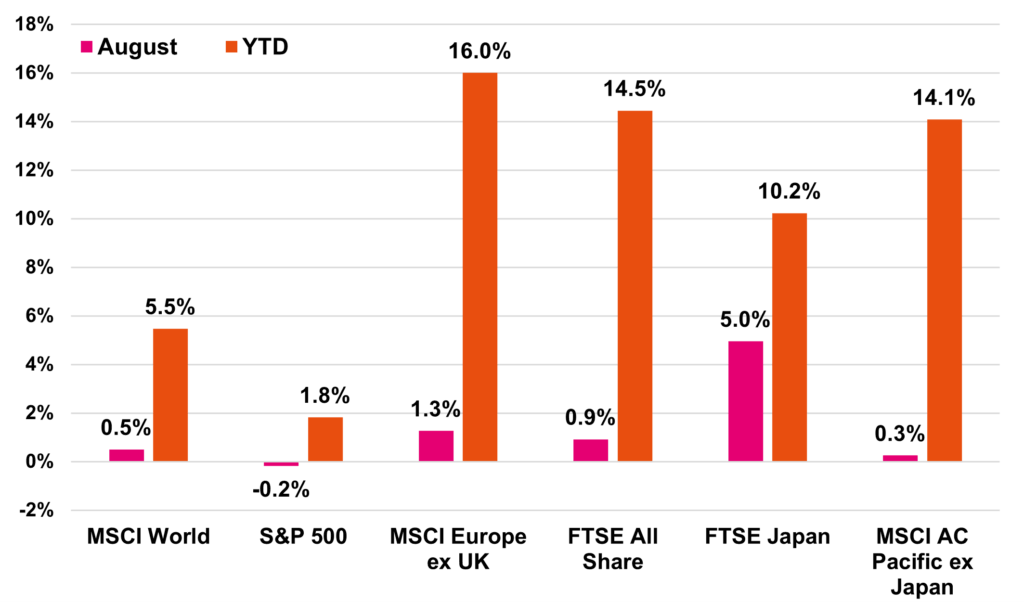

Despite headline risks, global equities continued their positive momentum from the summer with equities broadly higher across major regions.

US equities were flat in sterling terms (up 2% in USD) as renewed investor scepticism over the commercial benefits of AI weighed on technology stocks. This followed a research paper from Massachusetts Institute of Technology showing that fewer than 5% of AI pilot programmes were profitable. Even NVIDIA, which delivered one of the earnings season’s highlights with 56% year‑on‑year revenue growth, saw its share price fall after a data‑centre revenue miss – a reminder of the lofty expectations currently priced in.

In a case “bad news is good news,” US unemployment rose to 4.2%, but equities found support after Fed Chair Powell’s Jackson Hole remarks signalled shifting economic risks that could justify interest rate cuts.

Japanese equities advanced on news of a trade deal with the US, easing pressure on export‑focused companies. GDP growth also surprised to the upside, with the economy expanding 0.3% quarter‑on‑quarter. In Europe, political turmoil in France weighed on local markets, but at an aggregate level equities posted gains, building on strong year‑to‑date performance.

Regional equity returns

Figure 1. Regional equity returns (Source: Pacific Asset Management, August 2025).

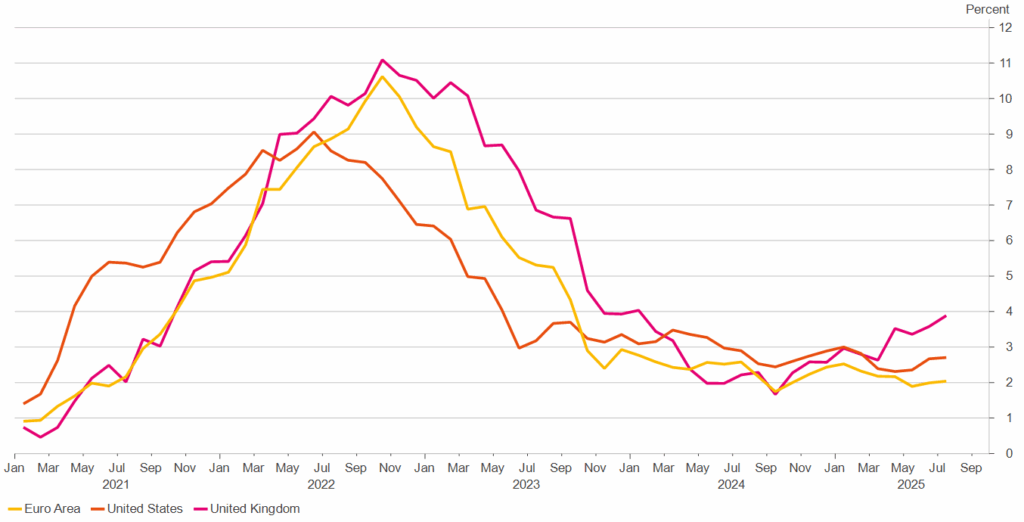

UK Macro and Inflation

The global economy continues to show resilience, but UK inflation once again surpassed expectations, reaching 3.8% in July versus expectations of 3.7%. Over the past year, UK inflation has more than doubled, while eurozone inflation has risen more modestly from 1.7% in September 2024 to 2.1% in August 2025.

Consumer Price Index, Change Y/Y

Figure 2. Inflation (Source: Pacific Asset Management, August 2025).

Drivers of the UK’s higher inflation include rising household service costs such as electricity, water and utilities, faster wage growth than in Europe, and the impact of new taxes and regulations. This poses a challenge for the Bank of England, whose 2% inflation target remains distant. The labour market is also showing signs of strain, with unemployment climbing to 4.7% – the highest in four years.

Rates, Yields and Fiscal Pressures

In early August, the Bank of England cut rates by 25bps to 4%, a two‑year low, but cautioned that further cuts may be less forthcoming than markets expect. Yields moved higher, with the 30‑year gilt reaching a 27‑year peak. This creates a vicious cycle for the UK government: higher yields raise borrowing costs, adding to the debt burden and pushing yields up further (see Figure 3.).

Figure 3. 30yr UK Government Bond yield (Source: Pacific Asset Management, August 2025).

This is not a UK‑specific issue. Across developed markets, yields are rising as investors question long‑term government fiscal stability. Political consequences are also emerging – in France, Prime Minister François Bayrou faces a confidence vote over a €43.8 billion budget cut aimed at reassuring markets about fiscal discipline. If unsuccessful, France could see its fifth prime minister in less than two years.

Attention will soon turn to the UK’s budget announcement on 26 November, with speculation building over the measures that may be introduced to address fiscal challenges. We will, of course, keep you informed as soon as we have more clarity. Until then, we’re reminded of a remark by former President of the European Commission, Jean‑Claude Juncker: “We all know what to do, but we don’t know how to get re‑elected once we have done it.”