The Fed turns hawkish

Inflation has proved to be much stickier than central bankers had believed, forcing them to delete “transitory” from their lexicon as supply chain disruption combined with a sustained strong demand for goods has pushed inflation higher and for longer than they expected.

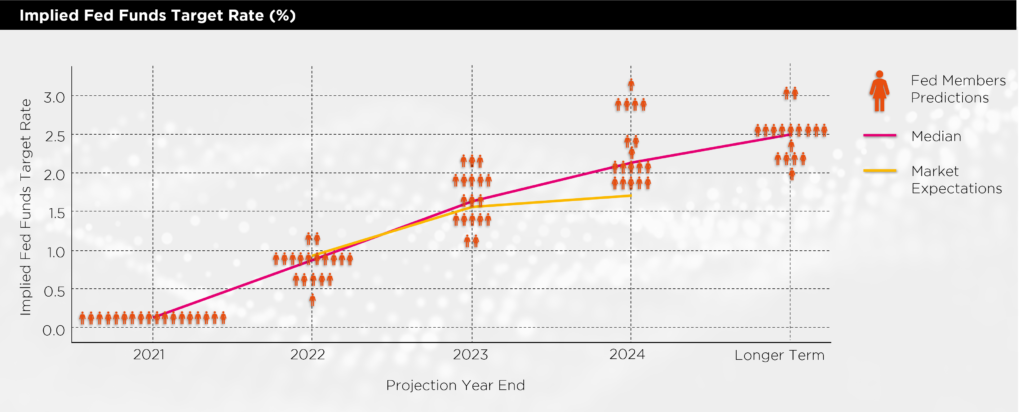

It may come as no surprise that interest rates need to rise, what is perhaps more remarkable is the view of markets as to how high they are likely to go. In the US, the Federal reserve lays out the views of the committee members expectations for interest rates over the next three years and longer term. On average, the FOMC members believe that by the end of 2024, interest rates in the US will be 2.25% whereas the market is pricing in a peak at around 1.7%. In the UK, the market is even more sanguine: here the market is predicting that interest rates will top out just above 1%. This is despite some forecasters expecting CPI inflation to move above 6% in April on the back of surging energy prices. Effectively the market is predicting that central banks can raise rates off the floor but push them too high and they will trigger a sharp slowdown in the economy.

The Fed and market pricing

Each icon in the chart below represents a member of the Federal Reserve expectation for interest rate in the future. The market is in agreement with the Fed in the short term but doesn’t believe they can raise rates as high in the medium term.

Source: Federal Reserve, Bloomberg

So, what does this mean for markets?

History has shown that the early stages of central bank tightening is usually supportive for equity markets as it’s a sign that the economic recovery is gathering pace. It’s only when monetary policy becomes too restrictive that the risk of a recession increases, and equity markets are at more serious risk. However, the tightening of monetary policy can lead to a pick-up in volatility and a change in leadership in markets. Equity markets rose in 2021 for rational reasons – corporate earnings grew rapidly. In fact, for most markets, earnings grew faster than prices increased and so most stocks got cheaper despite the strong gains. However, under the surface there were areas of the market that experienced price increases which were completely disconnected from fundamentals. There are often pockets of exuberance in markets, but last year saw some wild moves in stocks that soared to absurd heights for little to no reason. Perhaps the most absurd were the so-called meme stocks, so called because they are popular on social media, which were a symbol of the excess of liquidity in the market at the start of 2021. However, since then, the mere hint of the tightening of monetary policy is removing the froth from these stocks and has been working its way through the market. Starting with the meme stocks, before moving to non-profitable technology and now impacting the most highly rated companies whose outlook may be promising but whose valuations have become disconnected from reality. That’s the bad news for equity markets.

The good news is that there is a whole raft of stocks that have been shunned, precisely because they have had low sensitivity to yields. Value stocks tend to grow slower than growth stocks and so more of their future earnings come in the immediate future than in 10 years’ time. These stocks are trading at the widest valuation discount to growth stocks on record and some, such as financials, would see their earnings benefit from rising bond yields. Moreover, we think that in each sector, those companies that are cheap relative to their peers can outperform their more expensive competitors. As a result, we think value stocks can pick up the baton for equity markets in 2022.

For fixed income markets, hawkish central banks are certainly a headwind but it’s interesting to note that US Federal Reserve believes that the long-term target for interest rates is 2.5%. If they are right, this caps the amount that bond yields can rise. In the meantime, what is clear is that returns from much of the bond market is going to be low going forwards. So where else can investors generate returns apart from equities?

Opportunities in real estate

One area that we are finding opportunities is in commercial real estate. The commercial property market can be split into three parts: industrial and retail warehouses which are thriving, offices which are stabilising and the high street which is still slowly dying. Investment trusts provide exposure to all these sub sectors at varying discounts or premia to their underlying value. What’s interesting about the market today is that you can buy “pure play” vehicles – investment trusts that focus only on industrial property for example, but to own these assets you pay a premium to their underlying value. This makes some sense as their underlying values will be marked up when their valuations are updated for the end of the year.

What’s caught our attention is that we can buy diversified property funds, yielding nearly 5% trading at a 20% discount to their underlying value. Their property portfolios are spread across different sectors but have around 70% of their assets in industrial and retail warehouse properties whose valuations are rising sharply. The remainder is mostly in offices, whose valuations are starting to recover, and they have almost no exposure traditional retail property. The maths is simple: investors receive 5% a year in dividends plus any further uplift in property prices. But it’s the potential discount closure that’s the real kicker: if these vehicles return to par, where they traded pre-COVID, the trusts would gain an additional 25% as they rise from 80p in the pound back to 100p.

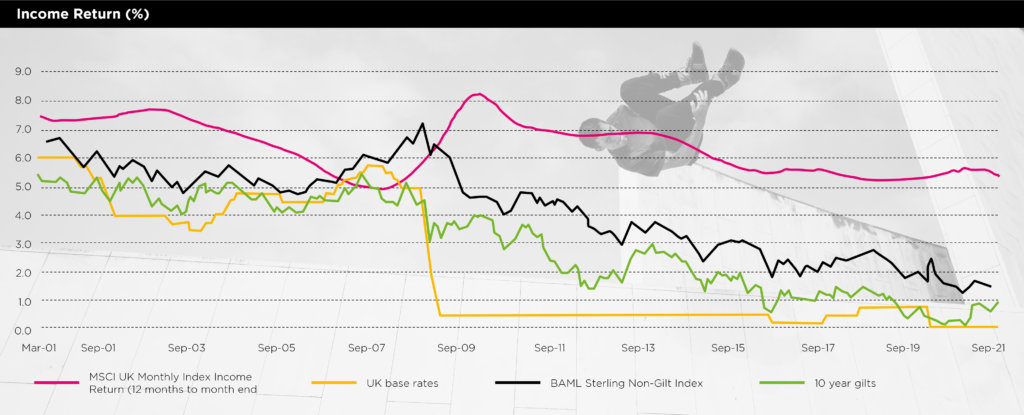

The gap between commercial property yields remains unusually wide compared to other asset classes providing a margin of safety should bond yields continue to rise.

Source: Bloomberg

Conclusion

Most central banks have indicated in no uncertain terms that it’s time to bring down the curtain on QE and start to raise interest rates. This has significant implication for the winners and losers within equity markets and is likely to usher in a more volatile period for markets. However, there are still attractive opportunities in both equity markets and alternative asset classes such as commercial property. In many ways, this is a more comfortable environment where some of the air is coming out of the extremes in markets and investors can focus on cheaper parts of the market, rather than hoping that expensive assets get more expensive. As ever, diversification remains key in an uncertain world.