Q2 was another eventful period for investors, shaped by shifting trade policies and rising geopolitical tensions in the Middle East. Despite these challenges, markets demonstrated resilience as worst-case scenarios did not materialise.

A key highlight was the US-China trade deal announced on June 11, giving the US access to China’s rare earth minerals, which eased investor uncertainty. This reduced tariffs on Chinese goods from 146% to 30%. This was followed by a separate agreement with Vietnam, where tariffs on Vietnamese goods – which were initially 46% on Liberation Day – were later reduced to 20% for direct imports, and 40% for trans-shipped Chinese goods.

Tensions rose sharply after Israel’s airstrike on Iranian nuclear facilities, causing oil prices to briefly spike above $80 per barrel amid fears of disruptions through the Strait of Hormuz, a vital route for nearly 20% of global oil shipments. Although Iran retaliated with a pre-telegraphed airstrike on US facilities in Qatar, a truce was eventually agreed, and oil prices retreated below $70 per barrel.

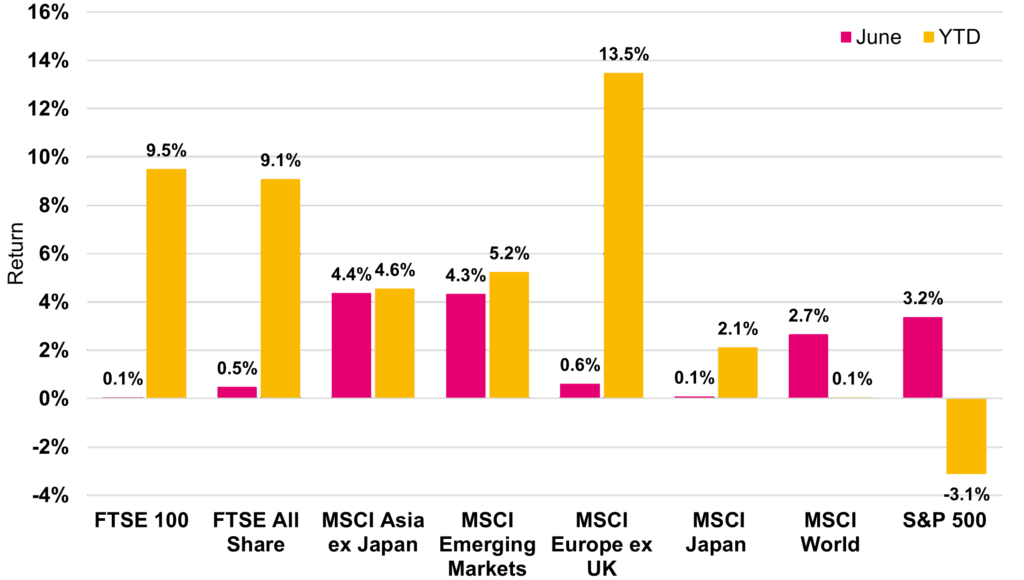

Equity markets sustained the positive momentum seen in May, with most major indices advancing (see Figure 1). The S&P 500 led, returning 3.2% (in GBP terms). Investors looked past a modest inflation uptick – the first in four months – and a contraction in US GDP, focusing instead on easing geopolitical tensions, an improved trade outlook, and stronger-than-expected corporate earnings.

Figure 1. Regional market returns (in GBP terms). Source: Bloomberg

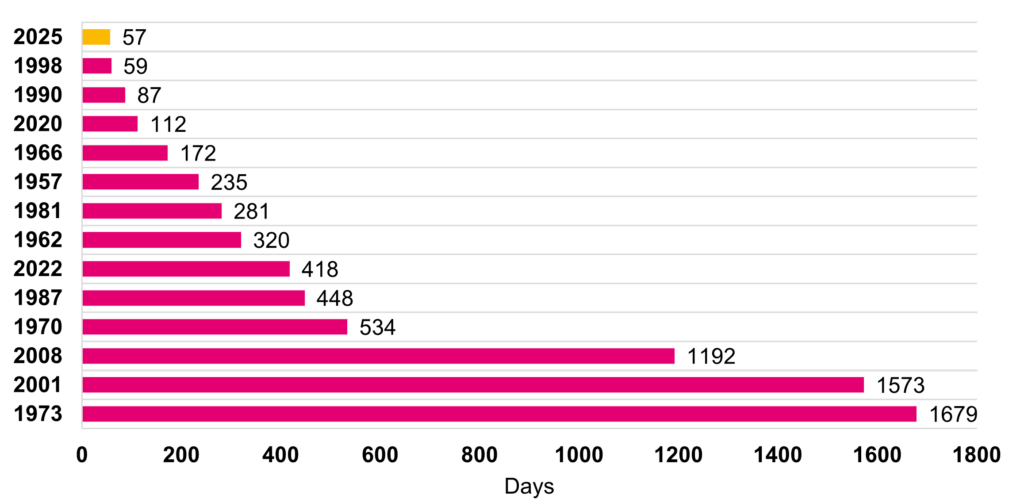

Gains were broad-based, with technology stocks outperforming, rising more than 7% over the month. This capped a remarkable first half for US tech companies, which rebounded 14% in Q2 after a 15% drop in Q1. The broader S&P 500 also staged one of the fastest recoveries on record, bouncing back from a 20% decline in just 57 days – the quickest since the 1950s. Historically, such recoveries have taken an average of 511 days (see Figure 2).

Figure 2. S&P 500: Days to recover from a 20% drawdown. Source: Norgatedata, Pacific Asset Management

Outside the US, the Euro Area’s GDP grew 0.6% quarter-on-quarter in Q1, following a 0.3% rise in Q4 2024 – its fastest expansion since mid-2022. With inflation moderating to 2%, the European Central Bank made the decision to cut rates by 25 basis points to 2%, marking its eighth cut in 12 months. This easing, combined with accelerating growth and fiscal support, helped European equities gain nearly 14% year-to-date.

In the UK, the Bank of England kept interest rates steady at 4.25% amid signs of labour market stress and slowing growth – a 0.3% GDP contraction in April. Markets now expect two further 25 basis point cuts by year-end. Despite the UK facing economic and fiscal challenges, the FTSE 100 hit an all-time high last month, buoyed by strong gains in major oil companies like BP and Shell, which rallied on the back of geopolitical tensions driving oil prices higher.

The recent US equity rally has sparked talk around the return of “US exceptionalism.” While the US outlook has improved, the bigger story lies in broader structural shifts underway globally. President Trump’s return has acted as a catalyst for change beyond US borders, prompting strategic realignments.

Europe’s political landscape has been transformed since early 2025. Germany now plans to deploy €1 trillion in spending, EU support has surged in a “rally round the flag” effect, and European policymakers are signalling intent to fill the leadership gap left by a more inward-focused US.

Looking ahead, we do not expect US exceptionalism to dominate as it has in the past decade. This is not a call to abandon US investments – the US remains home to some of the world’s most innovative companies, supported by a deeply rooted capitalist ethos. However, opportunities outside the US have grown meaningfully, especially among companies trading at attractive valuations, and poised to benefit from a more domestically focused US.

In this evolving environment, diversification remains essential – not just to manage risk, but also to capture opportunities across global markets.